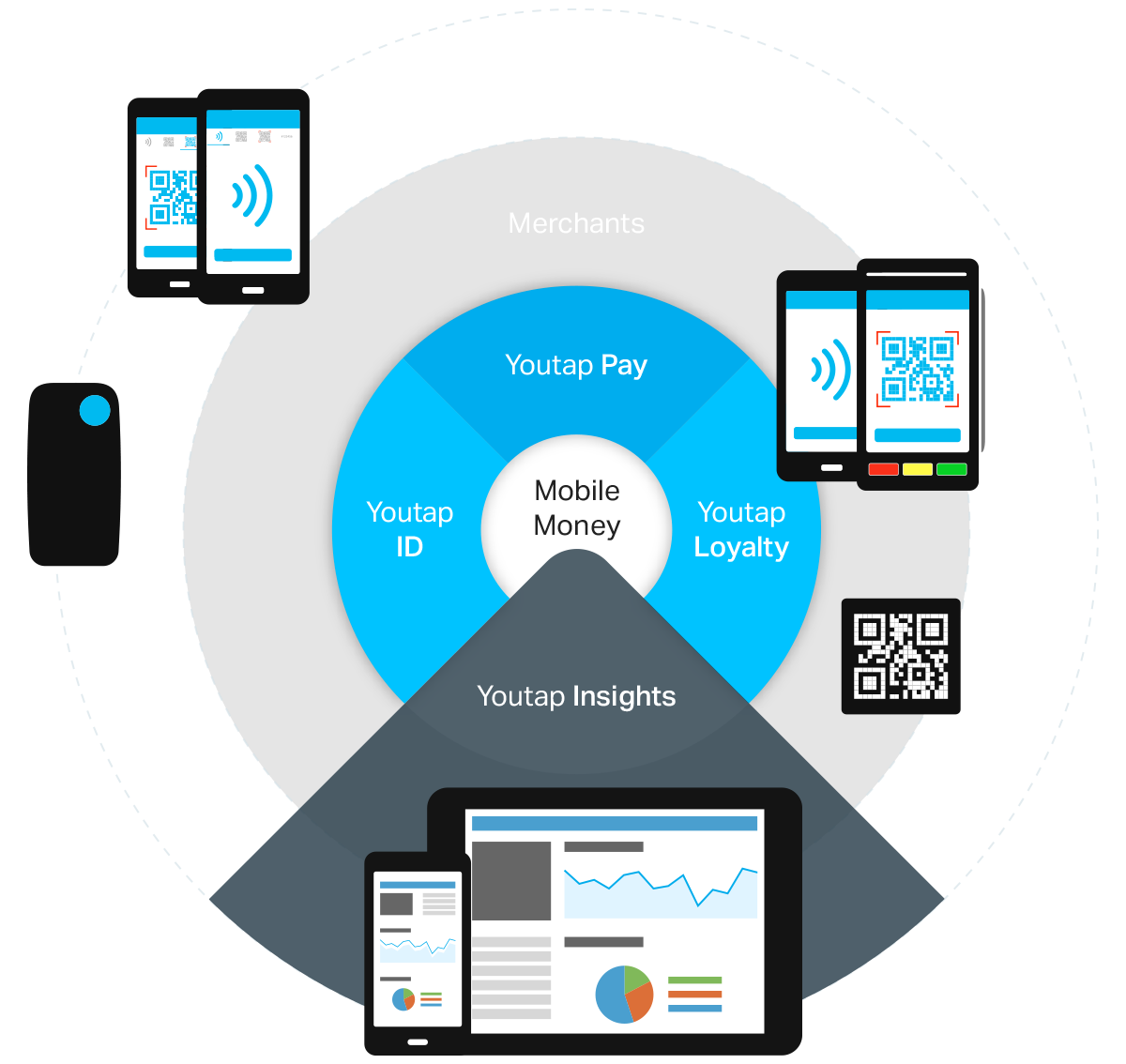

Youtap a global provider of contactless mobile payments and financial services software, has launched a QR code solution and smartphone apps for mobile money services in Africa and Asia.

Youtap’s solution enables customer-initiated or merchant-initiated QR code payments for smartphones and smart point-of-sale devices. The solution conforms to the BharatQR industry standard developed by Bharat, Mastercard and Visa. Youtap’s apps can be white-labelled and branded with the logo and colours of the mobile money service.

The new solution gives any merchant or small business owner with a smartphone the potential to download Youtap’s Merchant App, self-register, and start accepting mobile money payments. Likewise, any subscriber with a smartphone can download the Youtap Pay App and start making payments. Merchants who do not own a smartphone could be provided a printed QR code to accept mobile money.

Youtap’s QR code solution enables a full range of mobile money transactions, including cash-in and cash-out transactions, airtime top-ups, bill payments and in-store payments.

QR codes can also be used to give back change when a customer uses cash.

Smartphone penetration across the emerging markets is increasing significantly. Recently MTN Group published statistics on the growth of smartphones across its operating companies, including South Africa (15%), Nigeria (36%), Ghana (64%) and Côte d’Ivoire (100%). According to the GSMA, an association that represents the interests of mobile operators worldwide, smartphone adoption is expected to reach 50 per cent by the end of 2018.

In Asia, where smartphone adoption is high, QR codes are already widely used for payments.