On the surface, 4G service rollout in African markets appears to be going well. Around 115 LTE networks are commercial or expected to launch in the continent before the end of 2018. On average, since 2015, around 20 new 4G networks launch in Africa every year. Operators are reporting double-digit traffic growth numbers. The African 4G base has been doubling every year, though from a small base.

We estimate the number of 4G connections on the continent at around 50m in 2017, a number which, on current trajectory, should rise to around 90m in 2018. Subject to a variety of assumptions, the number of 4G connections should quadruple to reach close to 350m within the next five years.

So what’s the problem?

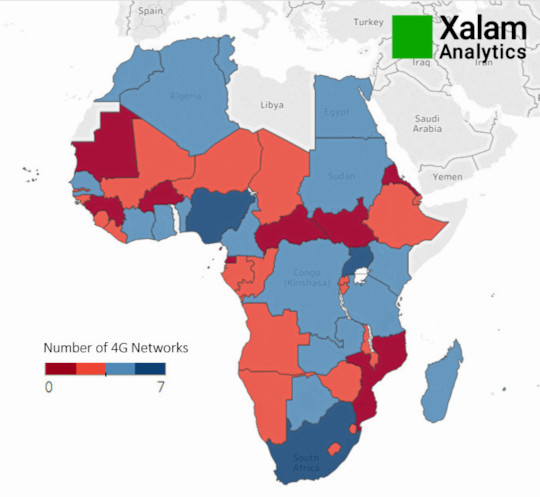

Look deeper, and Africa is falling fast behind the rest of the world on 4G adoption. The region accounts for ~5% of global mobile broadband connections, but only ~2% of 4G connections. Likewise, Africa’s contribution to 4G is materially lower than its broader contribution to global GDP, mobile subscriptions, or mobile broadband connections. African 4G penetration (of overall mobile subscriptions, or the population) is the lowest in the world, as is 4G network coverage of the population. Only about 25% of the African population is covered by 4G networks (vs. a 60%+ global average). Around 75% of Africa’s 4G connections come from five countries: Morocco, Tunisia, Egypt, Algeria and South Africa. Only a quarter of the African population even has access to 4G, and when they do, they’re not using it.

African 4G Commercial Availability, 2018

Sources: Xalam Analytics Research; the State of African 4G, 2018

There are other troubling signs. While the rest of the world is pushing ahead with 4G and pushing to introduce 5G, African 3G has remained robust. Data available from a sample of around 20 markets in sub-Saharan Africa suggests that mobile operators have added 20% more 3G base stations than 4G over the past 18 months. This pattern shows few signs of abating and is not necessarily a bad thing. Today, 3G is the most credible, readily available solution to extend mobile broadband coverage beyond core urban centers in a cost-effective manner. It’s the pragmatist’s solution.

Why is Africa falling behind on 4G?

For one, terrible spectrum economics. 4G spectrum allocation has been prolific in financial terms. But it has also been late, dysfunctional, and borderline disastrous for overall 4G market growth. Lower (and more cost-effective) 4G bands are either not available or not clean enough for use. Companies with capital do not have the spectrum. Those with the spectrum do not have the capital; M&A is frowned upon, so they’re generally not allowed to talk to each other. The outcome is predictably damaging. African operators are having to pay dearly for spectrum, only so they can use the most inefficient spectrum bands available to offer 4G services, compounding what is an already tenuous business case.

Africa is also falling behind because of terrible terrestrial fibre economics. In somewhat of an ironic technology twist, high-speed wireless access at scale is closely tied to the availability of abundant, affordable metro and interurban fibre networks. And yet, half of African markets are either strict, or loose terrestrial fibre monopolies. In many markets, critical issues around rights-of-way are essentially crippling the fibre marketplace, with a knock-on effect on 4G adoption. The expansion of satellite-base solution is helping – but this is an issue that cannot be fixed without better fibre economics.

The monetization of African 4G is highly problematic. For our report on the state of African 4G, we analyzed the operational and financial performance of around 70 operators, in 20 African countries, where relevant data is available, including around 20 operators with 4G services. We found no solid correlation between strong 4G adoption and increased mobile operator profitability. Far from helping turn around African mobile operators’ cash flow problems, 4G is making them worse over the medium term.

This is a problem. If stronger 4G adoption does not, in time, translate into better operating margins, its impact on cash flows can be utterly destructive, given the capital costs of purchasing 4G licences and rolling out networks. In our assessment, for many African providers, 4G will ultimately look like 3G did in Europe. A commercial success (in user terms), but an economic failure.

Why this matters – 4G impacts everything

At some level, the travails of 4G may very well not matter. First tier MNOs must deploy 4G to address demand, and because it is central to efforts to transform themselves away from a declining voice business. They must build, even if they lose money doing it. Further, the adoption of high-speed mobile broadband is an entrenched trend; while most projections of 4G connections should have a 10%-20% downside, the broader long-term outlook is consistent.

The problem, ostensibly, is the short/medium term, which we expect to be extremely challenging for the marketplace, as growth falls short and cash flow models get challenged. Over the medium term, this market is just not as big as we all think it is, traffic growth headlines notwithstanding.

This matters because 4G, in essence, impacts everything. It’s a barometer for how fast, and how ready the African market will be in entering the much ballyhooed fourth industrial revolution. 4G adoption is the baseline foundation for cloud services, data center, video streaming, and even e-commerce projections. African fintech is arguably the only sub-segment impervious to how fast 4G grows, as it is not as bandwidth-dependent.

We are already observing the impact of slower than expected 4G adoption on adjacent markets. SMEs sidestepping cloud services because of unavailable, or too expensive high-speed data services. Data center markets operating at 10% of their potential. Video streaming services not picking up as fast as expected, for largely similar reasons. Tighter e-commerce models due to a smaller than expected addressable base.

This will get better, to be sure. But if you’ve been building a business case assuming widespread 4G adoption in Africa over the next 2-3 years, you’re going to have to dial those back.

Part of this analysis is culled from – The State of African 4G – a Xalam Investor Report; October 2018. www.xalamanalytics.com