The State of Africa’s Gold Industry

|

Digitisation: A Game-Changer for African Gold Mines

The introduction of digital technologies, such as the geoforensic passport, optical AI, and blockchain, is revolutionising the gold supply chain, enhancing transparency and traceability. The World Gold Council’s (WGC) Gold Bar Integrity (GBI) platform, part of its broader Gold247 vision, aims to create a global network for tracking and verifying gold products. This platform has already shown promising results, with over 30 participants involved in the pilot program, including Rand Refinery and Argor-Heraeus.

- Geoforensic Analysis: Enables refineries to determine the origin of gold doré, reducing the risk of illicit material entering the supply chain.

- Optical AI (FeaturePrint): Creates a unique digital identity for gold bars, allowing for irrefutable identification, authentication, and tracing.

- Blockchain: Provides a secure, centralised ledger for certified gold bars, ensuring the integrity of the supply chain.

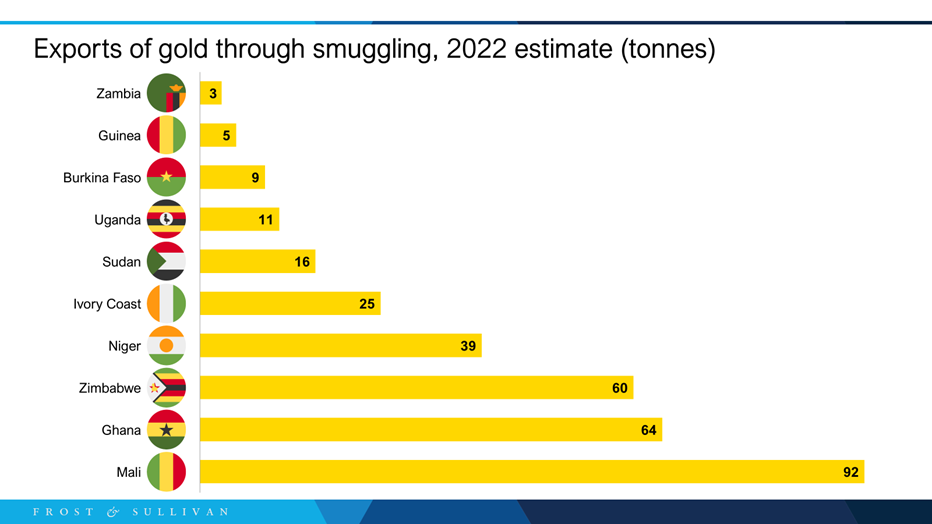

Combatting Illicit Mining Activities

Digitisation can effectively combat illicit mining activities in several ways:

- Formalising Artisanal and Small-Scale Mining (ASM): The WGC’s London Principles, adopted by central banks, aim to structure and formalise ASM, reducing the likelihood of illicit activities. However, challenges remain, such as the limited market access and poor pricing faced by smaller players. By leveraging digital tools, ASM operators can connect to larger, regulated markets, secure better rates, and operate within transparent frameworks, thereby reducing the incentives for illicit activities.

- Enhanced Regulatory Frameworks: Standardised regulations and increased enforcement can prevent informal mining sector fragmentation.

- Increased Transparency: Digitisation enables real-time monitoring, making it more challenging for illicit activities to go undetected.

Empowering African Mining Companies

By embracing digitisation, African mining companies can:

- Improve Supply Chain Management: Enhance transparency, reducing the risk of illicit material entering the supply chain.

- Increase Efficiency: Streamline processes, reduce costs, and improve competitiveness.

- Access New Markets: Meet global standards, enabling access to previously inaccessible markets.

Conclusion

Africa’s gold industry is at a crossroads. As the continent experiences a modern-day gold rush, mining companies, governments, and stakeholders must harness the transformative potential of digitisation to combat illicit mining activities and empower local mining companies to thrive. With the WGC’s Gold247 vision and the adoption of digital technologies, a more transparent, efficient, and sustainable gold industry is within reach.

Source: Frost & Sullivan, Engineering News, Swissaid, The Economist

Original Title: Unlocking Africa’s Golden Potential: How Digitisation Can Transform the Continent’s Gold Mines and Combat Illicit Mining Activities