As you may remember, January was a pretty quiet month with only $77m worth of deals announced on the continent. The good news is that things have picked up in February: 38 start-ups have raised at least $100k last month (in equity, debt or grants), the same number as in January. However, the total amount they announced is nearly 3 times higher, at $217m ($156m in equity and $59m in debt).

RELATED: AI startups raised $5.7b YTD, almost 40% more than in Q1 2023

The largest contributor by far (51% of the total) was Nigerian transport tech Moove who first announced $10m of debt for its India expansion, before rumours of an upcoming new round surfaced last week. We have been able to confirm directly with one of the investors that the $100m Series B is indeed happening. There were also 3 announced exits last months: Carbon bought Vella Finance, Auto24 acquired Kupatana and FairMoney might buy Umba. All in all, funding levels in February 2024 were quite comparable to 2020 and 2021.

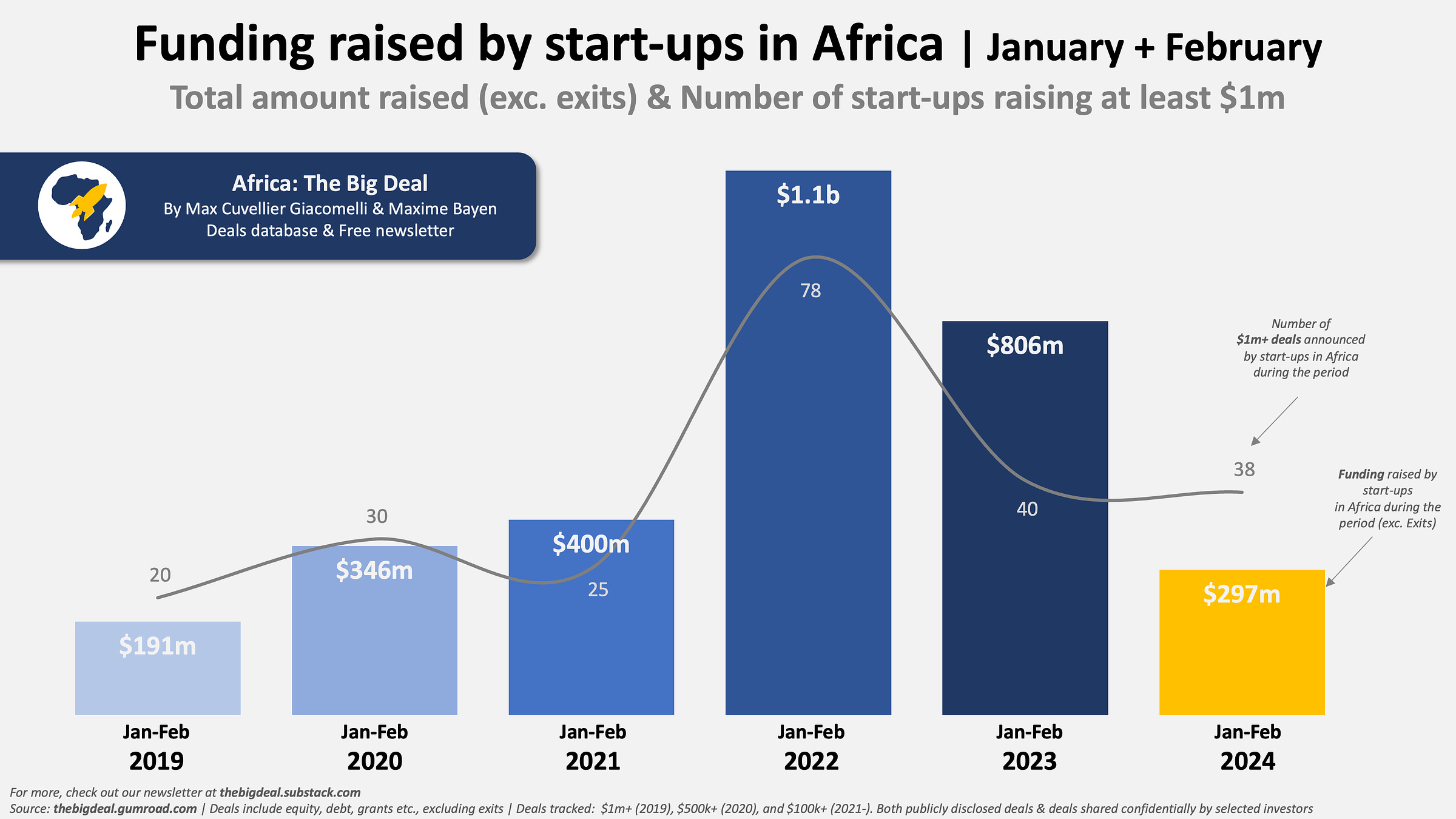

If we look at 2024 YTD (Jan+Feb), start-ups on the continent have raised just short of $300m. 80 start-ups have raised at least $100k, 38 of which have raised at least $1m. The Big Four have claimed 86% of all the funding, with Nigeria (42%, $123m inc. $110m from Moove alone) and Kenya (27%, $81m) in the lead, and Egypt (10%, $28m) and South Africa (7%, 22m) quite far behind.

Beyond those, only Uganda has registered more than $10m in funding this year so far. From a sector point of view, Logistics & Transport represented nearly half of all the funding (thanks to Moove, but also Roam), followed by Healthcare, Fintech and Energy; in terms of number of individual start-ups raising though, Fintech came first (18 out of 80, 23%).

Funding for Jan+Feb 2024 is lower than what it had been at the same time of the year in the past four years, despite a decent number of start-ups (38) raising $1m+ during the period. What could it mean for 2024 as a whole?

It’s obviously too early to tell, but here’s some maths, for what it’s worth: in an optimistic scenario (à la 2021 when Jan+Feb ended up representing only 9% of the total raised throughout the year), start-ups in Africa could be raising $3.2b this year; in an ‘average’ scenario (overall between 2019 and 2023, Jan+Feb represented 21% of the total total on average), we’d be looking at only $1.4b; we’d rather not discuss a pessimistic scenario. And as we know, the total is also very much dependent on mega deals, which may well already be in the works…

Credit: Substack