By Dawie de Wet

The satellite industry is growing rapidly, with recently developed Low-Earth Orbit (LEO) constellations such as Starlink and OneWeb now entering the Africa market and more LEO projects planned for the near future. With a total of 36 LEO projects in the pipeline and a collective forecast launch of some 63,416 satellites the next obvious question becomes, what does the future hold for current and projected Geostationary Orbit (GEO) satellite services?

Does this massive growth in LEO satellite deployment mean the end of the GEO satellite industry, will LEO services replace GEO services, and what impact could this have on the end-user and service provider industries? We look at some implications and discuss potential future GEO satellite service scenarios.

Introduction

Image Credit: Twoobii and Q-KON

Image Credit: Twoobii and Q-KON

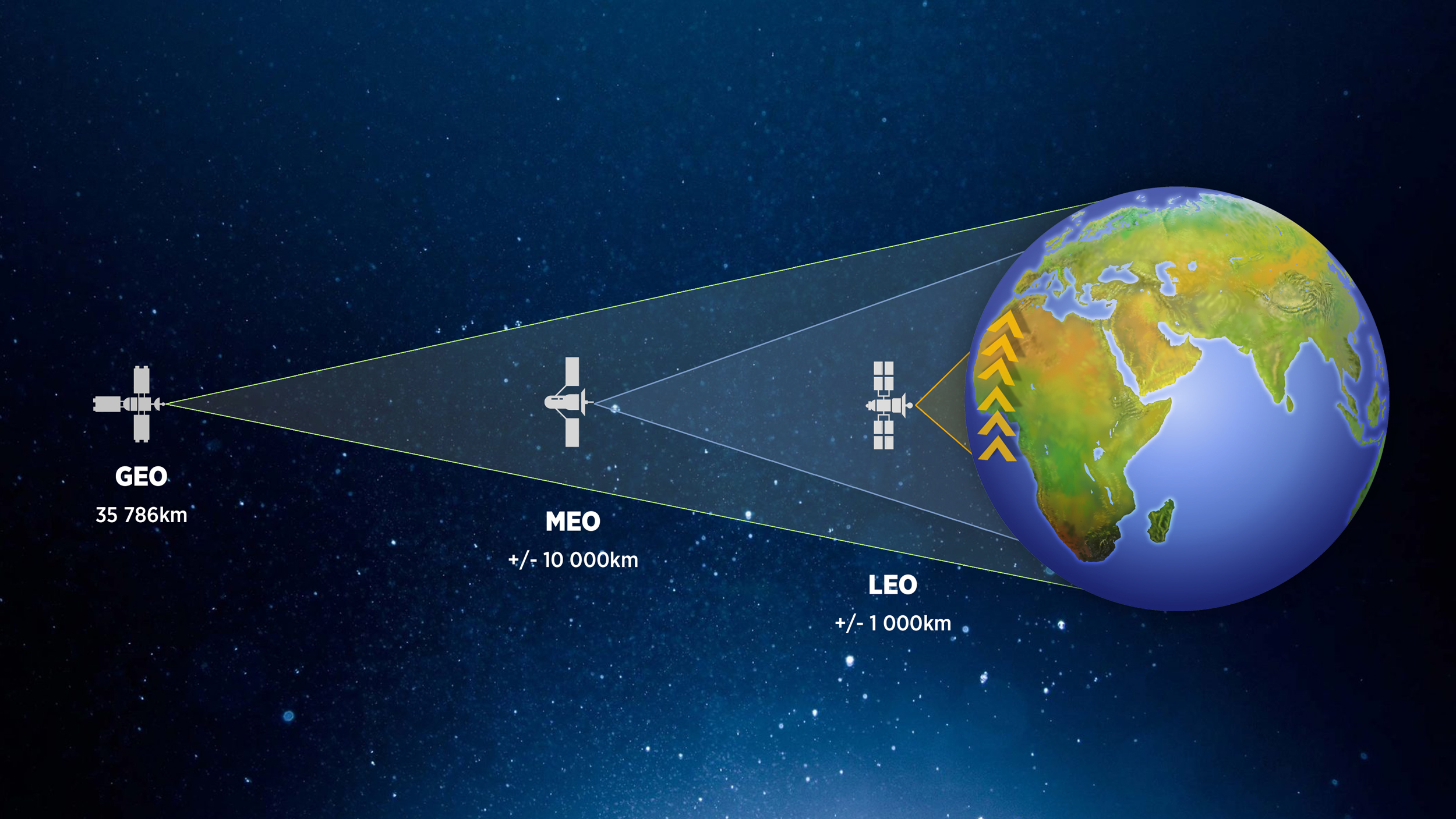

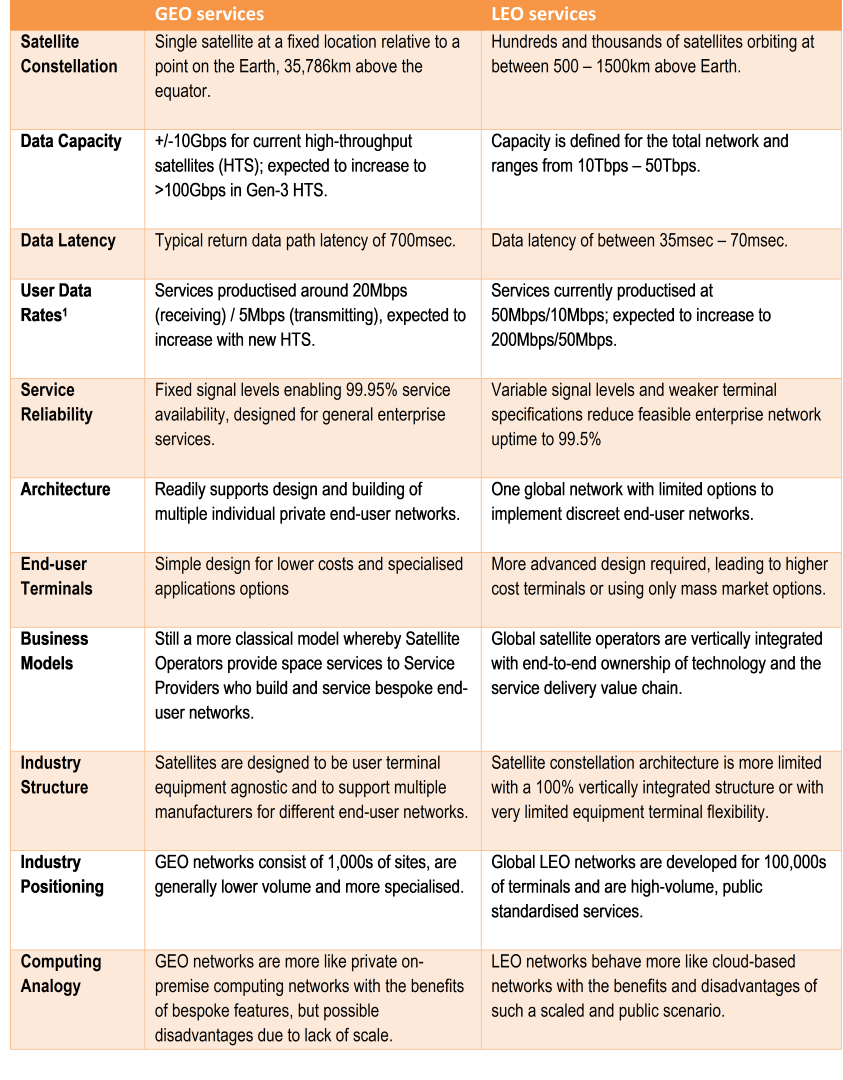

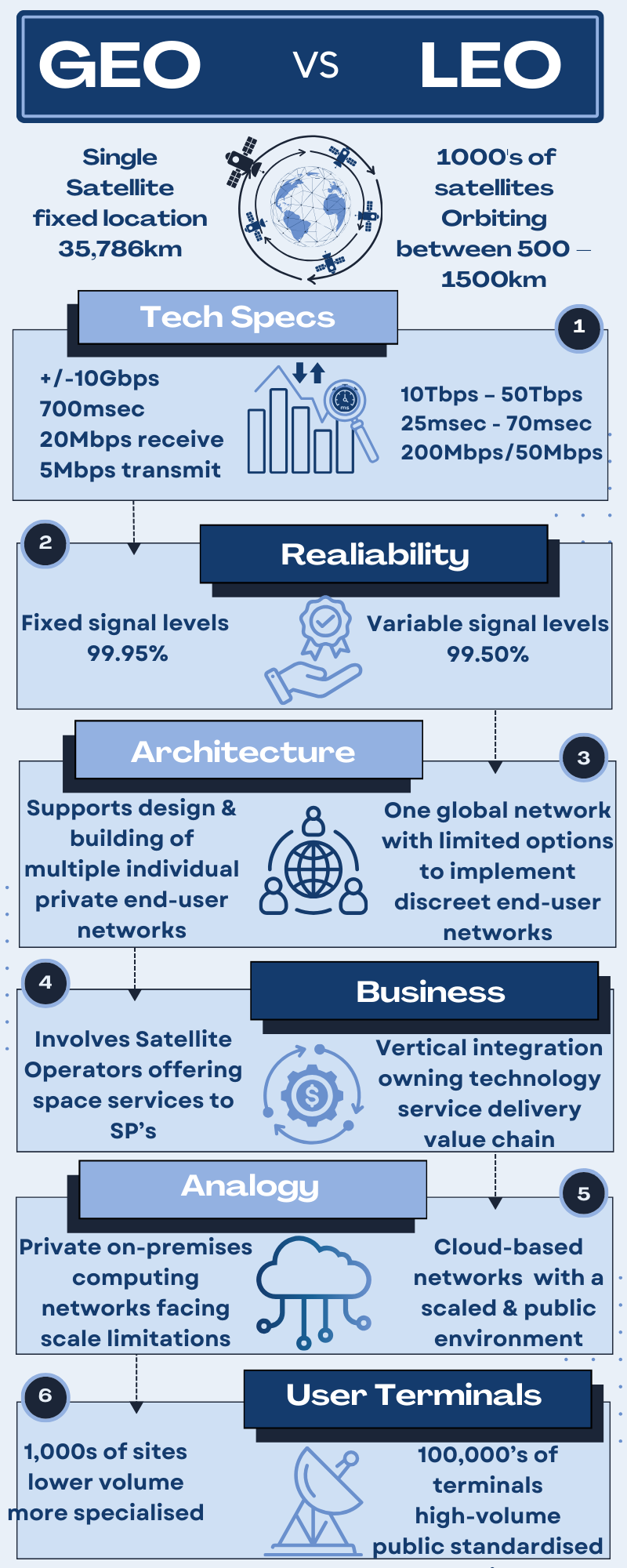

For context, we need to start with a brief review of the technology, industry and business model differences between LEO and GEO satellite services as summarised below.

(1): Reference data rates used for typical enterprise-type terminals

RELATED: ITU adopts new regulatory procedures for non-geostationary satellites

GEO services differentiation

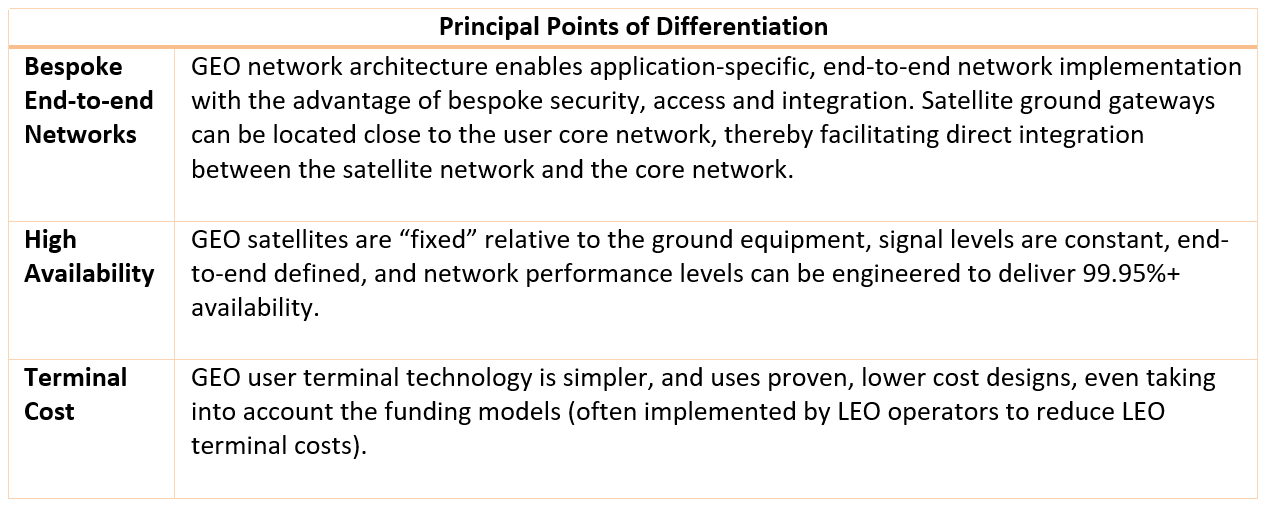

Mapping a way forward for GEO services in the Africa telecommunications industry context, we can leverage the following principal points of differentiation between GEO and LEO networks:

These points of differentiation lead to applications that benefit from bespoke user requirements, higher availability, lower costs and greater flexibility in terms of structure and operation. GEO services are best suited to servicing applications that require lower data rates and can tolerate higher rates of transmission latency.

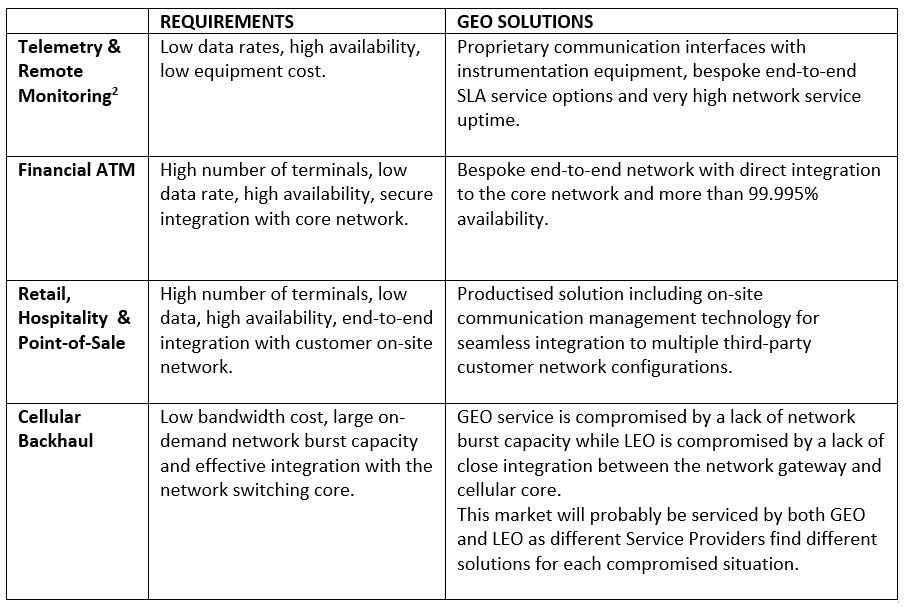

GEO services application mapping

Working on the principal characteristics of GEO satellite services and correlating these to end-user application requirements, we can draft some future application map options.

Implications of future GEO scenarios

While GEO services will continue to deliver specific user applications and market segments, current industry delivery models and business cases would probably need to be adapted considerably in order to unlock these sustainable future revenue scenarios.

The application of GEO services vs LEO services is geared more toward bespoke, end-to-end networks for specific customers and away from large-scale global open access platforms. This means that GEO constellation satellite operators that have recently developed vertically integrated service offerings and who have promoted managed services packages may find that such GEO offerings are weakly positioned to compete with similar global LEO managed services.

Future GEO market segments will be readily serviced by specialised turn-key providers such Q-KON (creators of the Twoobii GEO service and a leader in LEO deployment in southern Africa) with the focus on delivering specialised solutions for the financial, retail, manufacturing, tourism, and hospitality sectors, amongst others.

Conclusion

The large-scale deployment of LEO satellite services will certainly change the current satellite industry landscape – and change it permanently. The scope of these global platforms will be better suited to delivering enterprise, business and consumer broadband services and growth revenue streams by accessing the broadband markets currently being serviced by mobile and fixed wireless Telcos.

Sustainable future scenarios for GEO services could involve a pivot towards high-touch, specialised, end-to-end engineered networks that address specific user requirements in the financial, retail, industrial and government sectors. It is worth remembering that GEO satellite technology continues to evolve, and that the next generation GEO satellites will deliver improvements in data transmission speed, available bandwidth and cost.

Cover Image Credit: ktsdesign/BigStockPhoto.com

Article, Courtesy: Qkon

Dr Dawie de Wet (Pr. Eng. M.Sc. Eng.) is Group CEO of Q-KON and Chief Engineer for Twoobii, a southern African supported satellite broadband service. With over 30 years’ experience in designing, engineering, developing and implementing wireless, microwave and satellite communication systems in Africa, Dawie continues to focus on developing Telco solutions that meet the user requirements of emerging markets through world class-leading technology.