The Nigerian government appears set to shelve the implementation of the 5% excise duty tax on mobile telephone services, fixed telephone, and Internet services as it announced plans to reduce taxes in the country from the current 62 to no more than nine.

RELATED: EXECUTIVE NOTE – Multiple taxation: An impediment to economic development

Last year, government announced a 5% excise duty on telecoms services adding to the existing 7.5 % Value Added Tax (VAT) that consumers pay for goods and services to make the total tax value on telecom services 12.5% incurring the angst of consumers and operators.

Operators argued that the sector is already over-taxed having to contend with a multiplicity of duties across Nigeria’s 36 states that make up the federation.

This year, government suspended the implementation of the policy and later announced plans for a complete overhaul of Nigeria’s tax system with the establishment of a committee to reform Nigeria’s tax administration.

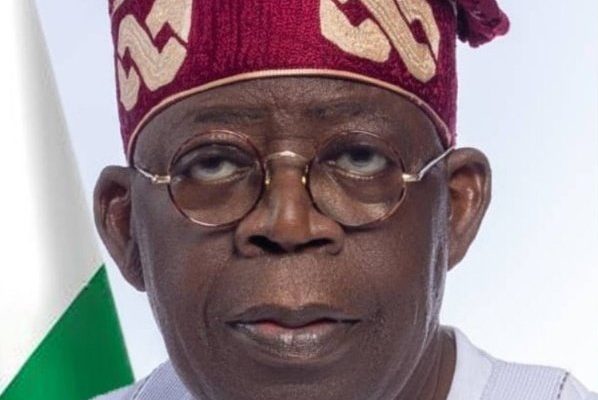

While inaugurating the Presidential Committee on Fiscal Policy and Tax Reforms, President Bola Tinubu said government was focusing on eliminating multiple tax regimes, creating a more business-friendly environment for investors, driving tax efficiency and making tax payment less cumbersome and complicated.

“Government should focused on areas that is still largely under-taxed and not scared off investors in thriving sectors like telecoms that needs support,” said one operator in Lagos.

IT/telecoms sector is backbone of economy

The IT/telecoms sector is touted as backbone of Nigeria’s economy accounting for about 17% contribution to the country’s GDP and about 30% of taxes collected by the Federal Inland Revenue Service.

However, operators say the sector is overwhelmed by excessive and sometimes, multiple taxations requiring a new tax administration that will be less cumbersome and more effective.

Chairman, Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele, while speaking at the 2023 annual conference of the Institute of Chartered Accountants of Nigeria in Abuja this week expressed government’s intention to rejig the national tax regime which requires some administrative intervention and constitutional amendments.

According to him, Nigeria’s tax revenue of N15. 194 trillion in 2022 reflects the inherent shortcomings when compared to South Africa’s N78 trillion revenue within the same period and from only 10 taxes.

He said Nigeria was working to have a more dynamic and efficient tax regime which will necessitate reducing taxes from 62 to single digit; “not more than nine.”