By Osasome C.O

War of Words Over Tax Reform’s Potential Impact on ICT and Education Sectors

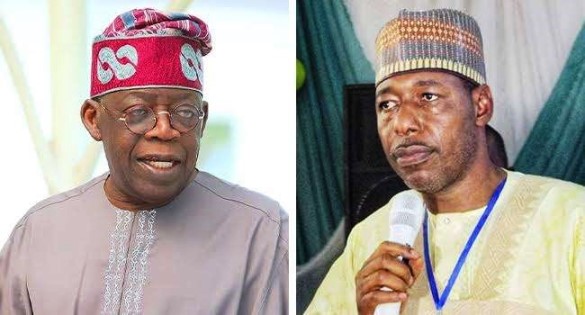

A heated debate has erupted between Borno State Governor, Prof. Babagana Umara Zulum, and the Presidency. This is regarding the implications of the contentious Tax Reform Bills currently under review by the National Assembly. Governor Zulum has raised alarm over provisions in the bills that, he claims, could lead to the dismantling of critical agencies such as the Tertiary Education Trust Fund (TETFund), the National Agency for Science and Engineering Infrastructure (NASENI), and the National Information Technology Development Agency (NITDA) by 2029.

RELATED: Nigeria to overhaul tax administration, address digital market and cryptocurrency

Speaking to Channels TV, Zulum expressed concerns over the bills’ stipulations, particularly the restructuring of the Federal Inland Revenue Service (FIRS) as the sole tax collection authority in Nigeria. He questioned whether the FIRS is equipped to handle this expanded mandate effectively.

“Another provision of the Tax Bill is that by 2029, TETFund will be scrapped because companies will cease to support TETFund according to the law… NASENI will be scrapped in 2029… NITDA will be scrapped… These are some of our concerns,” he stated.

Presidency Refutes Claims, Defends Reforms

In response, the Presidency categorically denied Zulum’s assertions. Special Adviser to the President on Information and Strategy, Bayo Onanuga, described the governor’s claims as baseless and misleading.

According to Onanuga, the proposed reforms aim to streamline tax administration and foster a business-friendly environment. This is in addition to ensuring that the national agencies remain functional. He emphasized that the bills do not suggest the dismantling of NASENI, TETFund, or NITDA.

“Contrary to the lies being peddled, the bills do not suggest that NASENI, TETFund, and NITDA will cease to exist in 2029 after the passage of the bills,” the Presidency clarified.

The government stated that Section 59(3) of the Nigeria Tax Bill seeks to consolidate multiple taxes into a unified framework to simplify compliance and improve efficiency.

Overview of the Controversial Tax Bills

The contentious bills include:

- Joint Revenue Board of Nigeria (Establishment) Bill, 2024 – SB.583

- Nigeria Revenue Service (Establishment) Bill, 2024 – SB.584

- Nigeria Tax Administration Bill, 2024 – SB.585

- Nigeria Tax Bill, 2024 – SB.586

If passed, these bills will empower the FIRS as Nigeria’s central tax authority, eliminating fragmentation in tax collection.

Impact on the ICT Sector and Education

The claim by Governor Zulum on the proposed reforms have sparked concerns in the ICT and education sectors. This is where agencies like NITDA and TETFund play critical roles. NITDA is central to Nigeria’s digital economy development, driving initiatives that support innovation, capacity building, and ICT adoption. Similarly, TETFund is a cornerstone for funding educational institutions and research, while NASENI fosters technological advancement.

Critics think it unlikely that government would scrap these agencies. Erasing them or merging them with other agencies could undermine the sustainability of digital transformation, education funding, and technological development in Nigeria.

Balancing Reforms with Growth

As stakeholders debate the tax reforms and future of these and other agencies, industry experts want government to focus on policy thrusts that will promote Nigeria’s technological and educational progress. They urge the government to engage in broader consultations to align the tax reform’s objectives with the nation’s growth priorities.

For now, the fate of the ICT sector and other key areas hinges on the National Assembly’s deliberations, with the outcome likely to shape Nigeria’s economic landscape for years to come.