NewsworthyData in its latest report is revealing which of the current trillion-dollar companies will most likely be the first to reach a $4 trillion market capitalisation.

RELATED: ChatGPT consumes $29.71m worth of energy to handle over 78 billion user queries every year

American chipmaker Nvidia, one of the biggest winners of the AI boom, which recently saw its market value soar past $3 trillion, once again exceeded Wall Street’s expectations. The company reported over $30 billion in sales for its fiscal second quarter, a 122% rise from the same period last year and above analysts’ predictions of $28.7 billion. Nvidia even increased its buyback program with plans to repurchase $50 billion in shares.

However, for a company that has been growing at such an extraordinary pace over the past two years, even stellar results might not be enough to satisfy investors. Despite the impressive figures, Nvidia’s shares dropped nearly 7% after the earnings announcement, wiping $200 billion off its market value. This sharp decline highlights just how sky-high expectations for Nvidia had become.

Nvidia will become first company to reach a $4 trillion market cap – BestBrokers

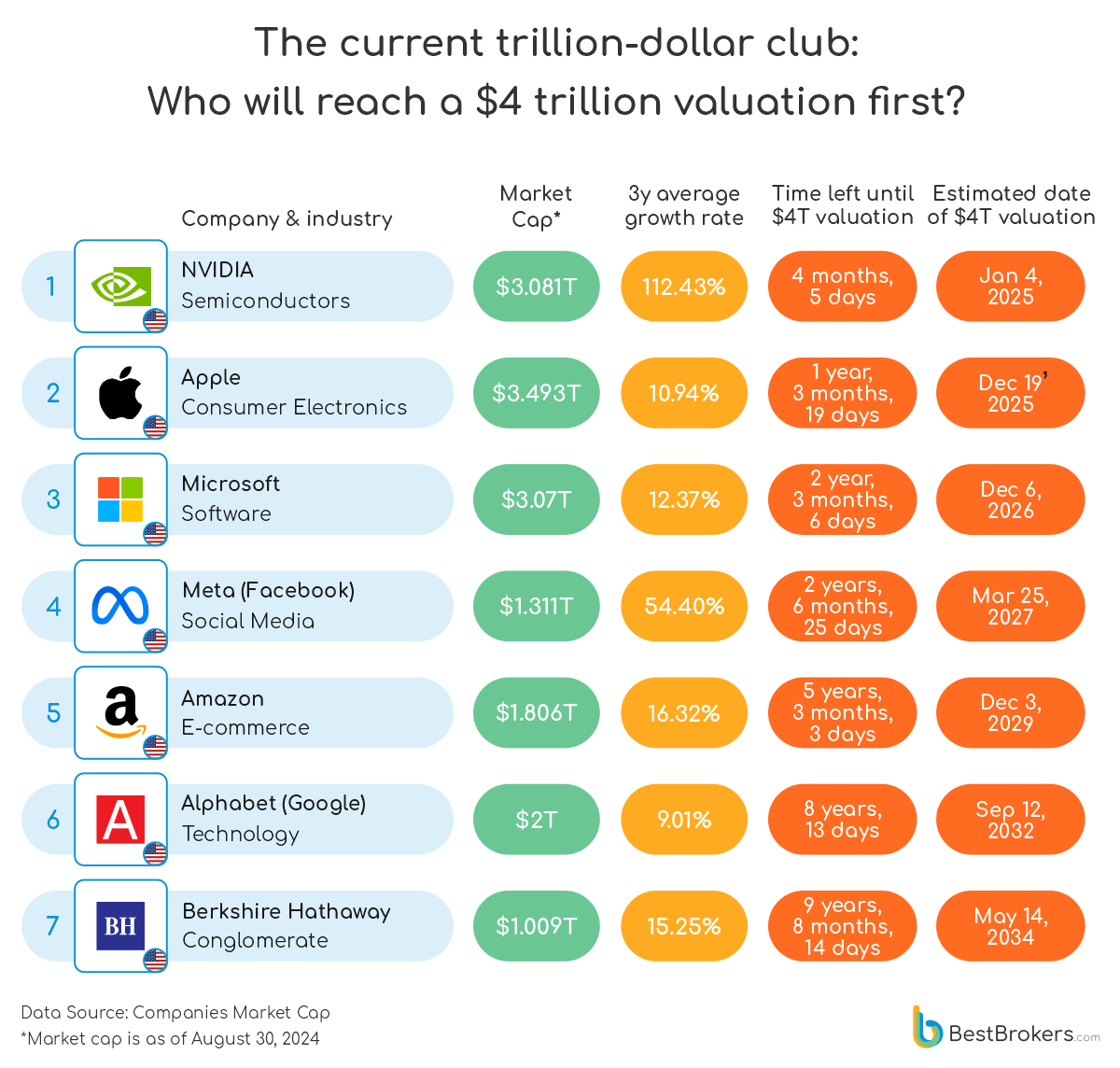

Still, despite its stock dip, Nvidia is poised to become the first company to reach a $4 trillion market cap, according to our team at BestBrokers, which analysed the market capitalisations of current trillion-dollar companies and projected their future values using their historical average growth rates since 2022. After recalculating based on the latest data from August 30, 2024, we predict that Nvidia, valued at $3.081 trillion as of the early hours of the day, will hit the $4 trillion mark around January 4, 2025, if it continues to grow at its annual average rate of 112.43% per year.

Key takeaways from our report:

- Two companies are on the fast track to surpass the $4 trillion mark within the next year, with Nvidia leading the charge. Valued at $3.081 trillion as of the yearly hours of August 30th, 2024, Nvidia is expected to hit this milestone in just over four months from now, by January 4, 2025.

- Apple is following closely behind. Based on its average annual growth rate of 10.94% since 2022, Apple is projected to reach $4 trillion by December 19, 2025 despite its higher market capitalisation of $3.493 trillion.

- Microsoft, with a market cap of $3.07 trillion and a recent average growth of 12.37% per year, is likely to be the third company to reach a $4 trillion valuation, around December 6, 2026.

- Meta Platforms ($1.311 trillion) and Amazon ($1.806 trillion) are also growing fast, at rates of 54.40% and 16.32%, respectively. If they keep it up, they could both surpass $4 trillion before Google, which, despite its current $2 trillion valuation, might not reach the mark until September 12, 2032.

- American conglomerate Berkshire Hathaway, which just recently became the eighth U.S. company to reach a $1 trillion valuation, is expected to be the last to hit $4 trillion in market value. This would likely happen around May 14, 2034, which is over nine years from now.

Despite being a trillion-dollar club member with a market cap of $1.802 trillion as of August 30, 2024, oil giant Saudi Aramco is not included in this projection. Our calculations indicate a negative trend in its average growth over the past three years, suggesting that its market capitalization is more likely to decrease than grow.

For this report, our team at BestBrokers analysed the market capitalisations of trillion-dollar companies as of August 30, 2024, using data from CompaniesMarketCap.com. We examined each company’s year-over-year growth from 2022 to August 2024, calculated their average growth rates, and then applied these rates to estimate when each company is likely to hit the $4 trillion milestone.

For more details on these projections and the methodology behind them, please refer to the full report here.

Credit: BestBrokers