The federal government will be taxing profits made locally by the likes of Facebook, Google and other global technology and digital giants who, though have no physical offices in Nigeria, have significant economic presence.

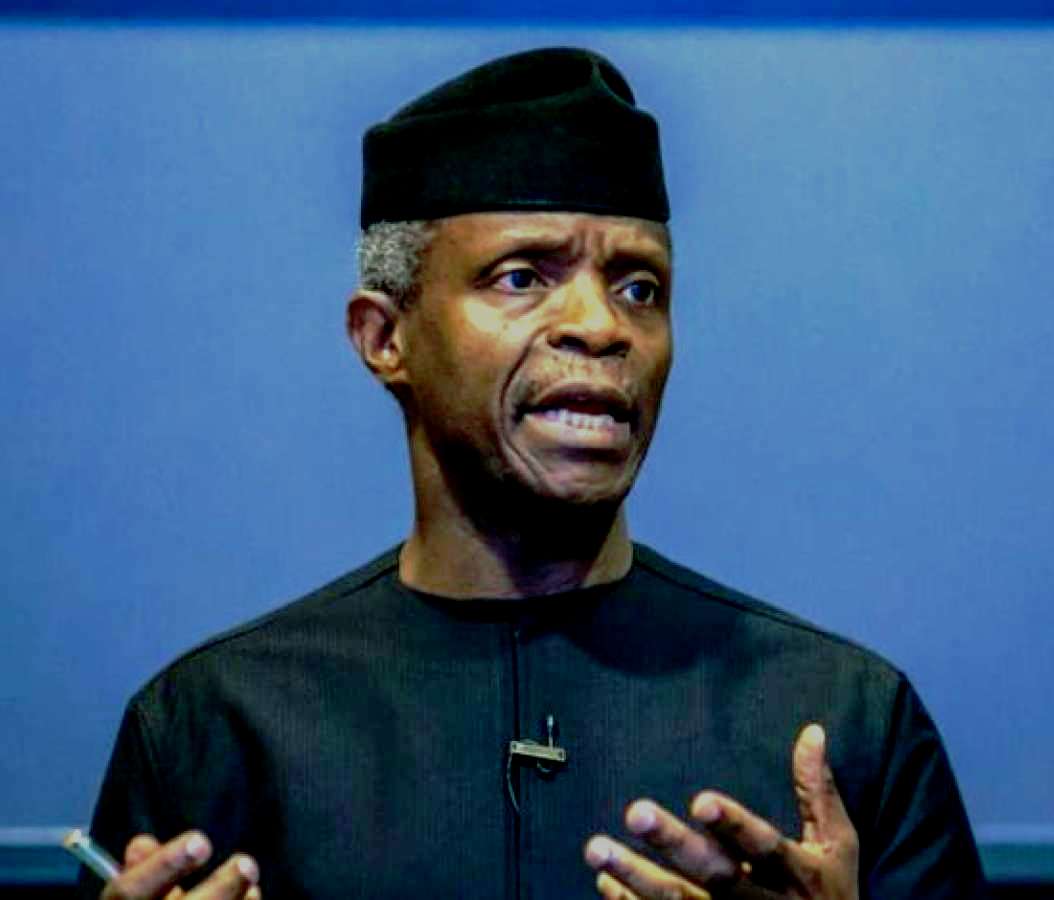

Vice President Yemi Osinbajo revealed this at a recent interactive session inside the Presidential Villa with delegates from the Chartered Institute of Taxation of Nigeria (CITN). The delegation was led by the CITN’s president, Mr. Adesina Adedayo.

The federal government assured that it will not be increasing taxes but will be leveraging on existing tax provisions that allows it to collect taxes on profits made locally by the Big Tech – global technology and digital firms with no physical offices in Nigeria.

RELATED

Why Africa Must Tax The Digital Economy

Nigerian Taxman FIRS To Charge You N50 Stamp Duty On WhatsApp Messages, ATM Printouts

Government Needs More Stakeholders’ Consultations For Digital Tax To Be Effective – Naro Omo-Osagie

‘Nigeria Needs Right Frameworks On Challenges, Opportunities In Digital Economy And Tax’ – Pirfa Jingfa Tyem

Nigeria Raises VAT To 7%, To Tax Online Transactions From January 2020

Commonwealth Finance Ministers Urge Progress On Taxing Digital Commerce To Tackle Debt

“Section 4 of the Finance Act 2019 provides that the finance minister, may by order of the president, determine what constitutes the significant economic presence of a company, other than a Nigerian company,” notes a statement released on Sunday by the vice president’s media aide, Laolu Akande.

The Finance Act had evidently demonstrated that the country was prepared to ensure that the global Big Tech firms were equally and fairly taxed for every local income they make, Osinbajo said.

Read the full statement below.

“While the Federal Government will not be raising tax rates at this time, based on the Finance Act 2019, it’s already empowered to widen the tax net.

“This includes collecting taxes on the Nigerian income of global tech giants with significant economic presence here, even if they have not established an office or permanent establishment, and are currently not paying taxes in Nigeria.

“In this regard, Section 4 of the Finance Act 2019, provides that the finance minister, may by order of the president, determine what constitutes the significant economic presence of a company, other than a Nigerian company.

“We’ve had severe economic downturns, which of course implies that we may not be able to collect taxes with the aggressiveness that would ordinarily be expected.

“I think the most important thing is that we must widen our tax net so that more people who are eligible to pay tax are paying.

“I’m sure you are aware of the initiatives including the Voluntary Assets and Income Declaration Scheme (VAIDS), which was also an attempt to bring more people into the tax net, including those who have foreign assets.”