Facts about Q3 2023

What should you know about start-up funding in Africa in the past quarter?

By Max Cuvellier Giacomelli

Round-Up. We’re not going to lie: it was a bit of a stretch to put it together at a pretty busy time, but the great feedback we received made it all worth it. And it seems we’ll be back with one of those next quarter for a Quarterly and Yearly Round-Up… In the meanwhile, you can download the deck we presented here. But we thought it might also be helpful for you to have a 10-point summary of key Q3 2023 data.

RELATED: Funding down for African startups inside the Big Four

So here we go:

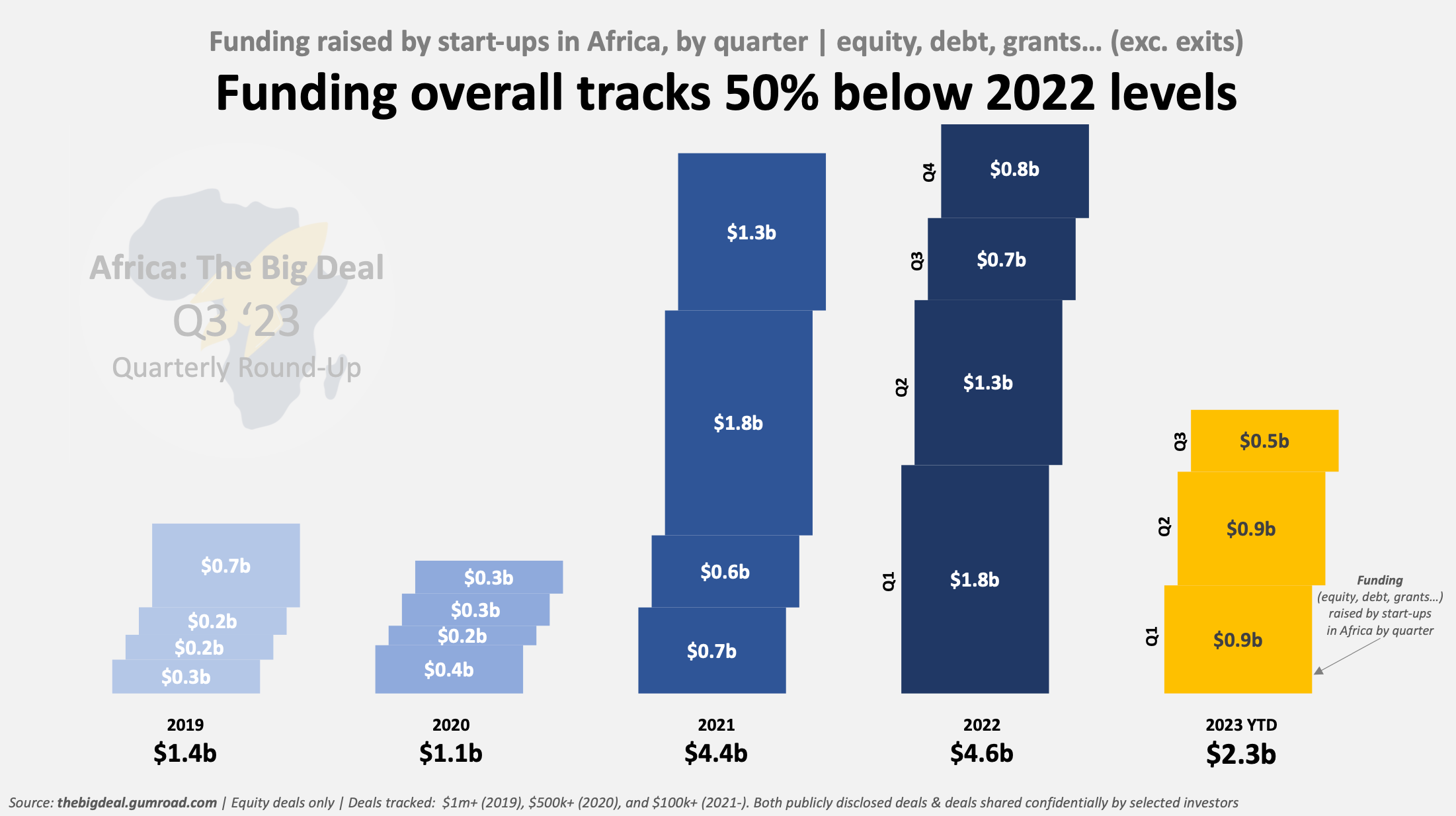

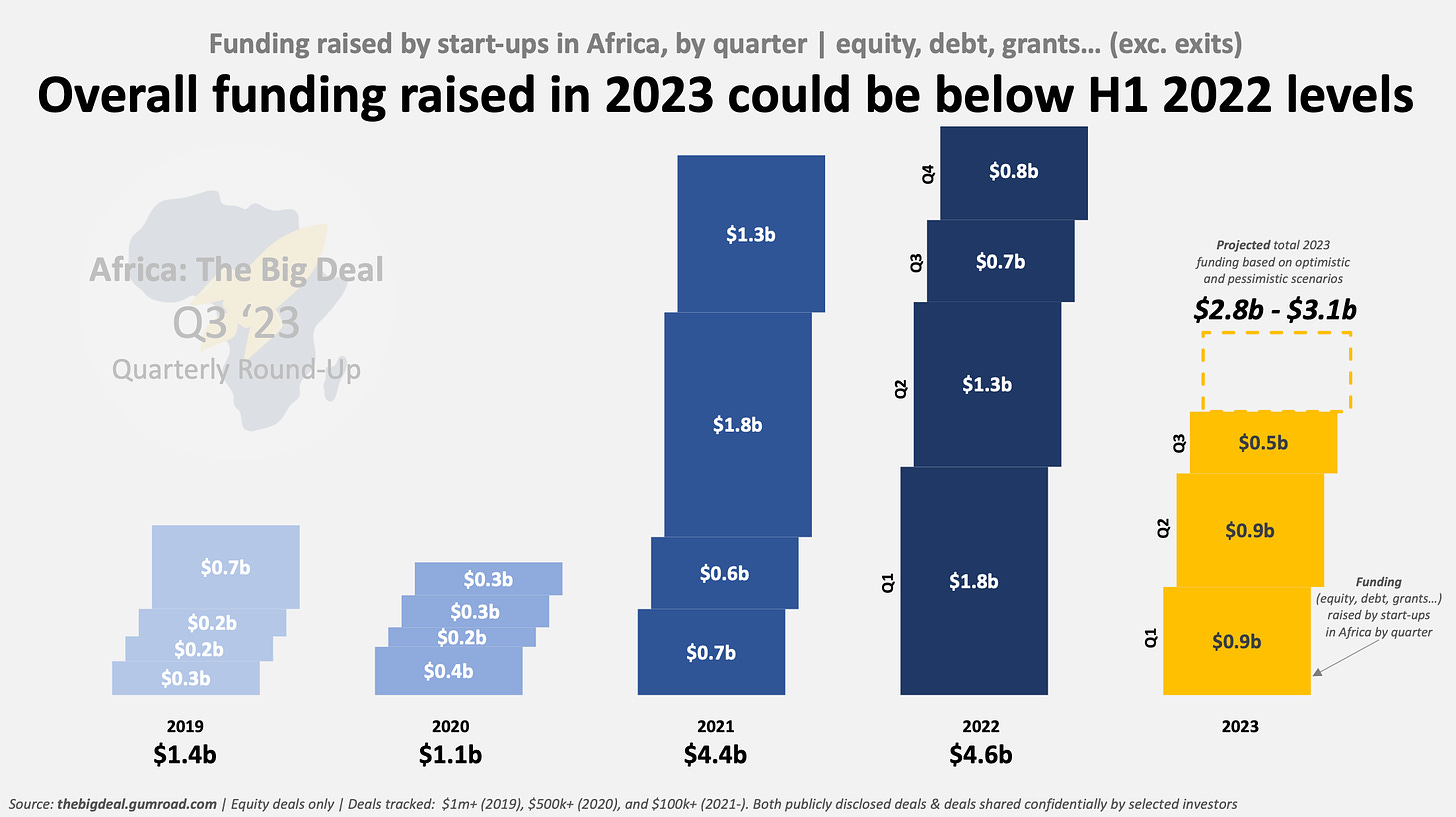

- Start-ups in Africa raised half a billion dollars in Q3 2023: $324m equity + $176m debt.

- Quarterly funding raised (both equity and equity+debt) was at its lowest level since Q4 2020.

- $2.3b ($1.4b equity + $0.9b debt) have been raised since the beginning of the year, less that half of the total amount raised in 2022.

- For the first time since mid-2020, no mega deals were recorded in Q3 2023.

- Nigeria was in the lead with 36% of the total equity funding raised. On the contrary, Egypt underperformed. Since the beginning of 2023, there is a relative balance in terms of equity funding raised amongst the Big Four.

- Fintech continues to be the leading sector in terms of equity funding raised, though its share is historically low (with the exception of Q4 2022). Energy and Logistics & Transport complete the top 3.

- Female CEOs raised 19% of the total equity funding, their highest share since Q1 2021. This percentage has been growing steadily for the past four quarters.

- 73% of the equity funding went to start-ups with no female (co-) founder(s) while on the contrary less than 2% was raised by start-ups with no male (co-) founder(s).

- Total 2023 funding might reach $3b (equity + debt), $1.5b short of 2022 and 2021 levels. 2023 equity funding might not reach half of its 2022 and 2021 levels.

- If you’re looking for more, you can

Courtesy: Africa: The Big Deal