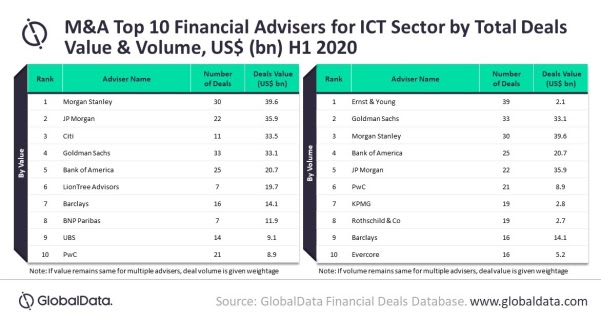

Morgan Stanley and Ernst & Young (EY) were the top mergers and acquisitions (M&A) financial advisers in the global information and communications technology (ICT) sector in the first half (H1) of 2020 based on deal value and volume, respectively.

Morgan Stanley advised on 30 deals worth US$39.6bn, which was the highest among all advisers. EY led in volume terms having advised on 39 deals worth US$2.1bn, according to GlobalData, a leading data and analytics company.

Aurojyoti Bose, Financial Deals Analyst at GlobalData, comments: “EY, Goldman Sachs and Morgan Stanley were the only three firms to advise on 30 or more deals. However, there was a wide disparity in deal value among these three firms with Morgan Stanley topping the chart by value and Goldman Sachs securing fourth position, while EY did not feature among the top ten advisers by value.”

“The average deal size of transactions advised by Morgan Stanley and Goldman Sachs were US$1.3bn and US$1bn, respectively, while it was just US$53.9m for EY.”

JP Morgan occupied second position by value with 22 deals worth US$35.9bn, followed by Citi with 11 deals worth US$33.5bn. Goldman Sachs occupied second position by volume with 33 deals worth US$33.1bn, followed by Morgan Stanley.

Image available to download. Please click here.

The number of deals announced in the global ICT sector decreased by 7.3% from 9,804 in H1 2019 to 9,084 in H1 2020, according to GlobalData’s Financial Deals Database. Deal value decreased by 31.3% from US$355bn in H1 2019 to US$243.8bn in H1 2020.

Morgan Stanley, which topped the ICT sector deals league table by value, stood at third position (by value) in GlobalData’s recently released global league table of top 20 M&A financial advisers. EY, which topped the ICT sector league table by volume, also occupied the top position (by volume) in the global league table.