By Sherry Zameer

Today’s consumers rely on their mobile devices not just for communication but to perform a growing range of functions online; provided they get a seamless end-to-end experience.

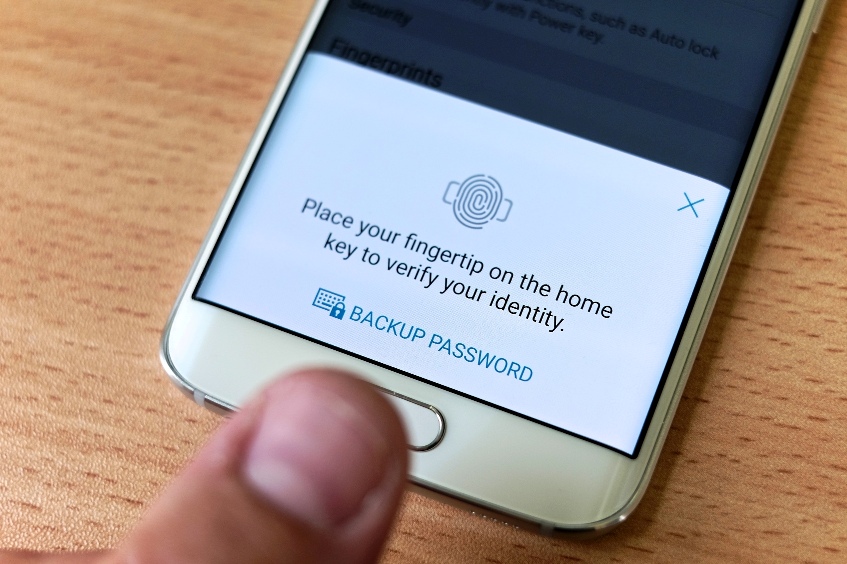

In recent years, mobiles have become an identification device. Almost half (48%) of consumers globally, including South Africa, expect their mobile devices to become their main form of ID by 2025, according to a global survey conducted by digital security leader, Gemalto. Mobile devices are slowly but surely emerging as promising replacements for traditional ID cards due to new technologies like biometrics, with a single means of authentication to securely access online services, confirm transactions and sign documents. Gemalto’s survey finds that 70% would use their mobiles as passport or national ID if security was guaranteed.

Technological evolution

When it comes to the capabilities offered by smartphones, a key determinant is the quality of the networks. African mobile operators continue to spend large sums on upgrading their networks.

Consumers today, expect super-fast data speeds, with half (50%) estimating over 100 Gigabit speeds will be normal. 5G, the next major advance in mobile connectivity, could potentially deliver speeds of up to 12 Gigabits per second, so there is still some way to go to meet consumer expectations.

According to Gemalto’s study, 60% of respondents anticipate their smartphones will be able to exercise full autonomous control over their home devices such as heating, lighting, windows, without any human intervention in the management of the system. This hands-off approach, would make their lives much more convenient, but require the devices to be trusted as reliable, secure and able to protect data privacy.

Payment Experience

Globally, mobile payments have soared in recent years and the research suggests this trend will continue. They have been slow to take off in South Africa perhaps due to the fact that the country has a developed banking system-take up has been stronger in other African countries. Nevertheless, there are signs that mobile payment is growing steadily², particularly in the retail and services sector.

On the consumer front, almost half (45%) of consumers globally expect to be able to use mobile devices to pay for anything, anywhere, at any time by 2025, and 43% consider mobile as their preferred payment method.

When it comes to mobile banking apps, banks will have to rapidly complete their digital transformations as almost half of consumers (42%) globally expect they will be able to perform all banking functions from their mobile device, by 2025, without any restrictions. Another key finding from the research is that almost a third of respondents (29%) think they won’t need to visit a physical bank branch. Technology based on facial recognition and the uptake of online ID document verification, which enables a user to set up a new bank account without having to visit a bank’s branch, will dramatically facilitate any kind of enrolment for those willing to embrace a fully digital experience.

Mobile Services and Data Privacy

When it comes to data privacy, the study shows that consumers are, in many cases, open to sharing some of their data as long as they get tangible benefits in return. 34% would be happy to receive deals and advice in real time via location tracking, while 28% are open to share their browsing history information or online purchases to be offered better deals. Nearly one in five (19%) expects the cost of mobile subscriptions and services to be offset by advertising, and almost one in 10 (8%) say they would be prepared to trade personal data in return for partial or full discounts on their bill.

Data privacy does, however, remain a major concern with 38% of respondents stating they don’t want any company to have access to their personal data,. Consumer engagement with their mobile operators is also set to significantly change. The use of on-demand Artificial Intelligence (AI) is particularly interesting, with over a third of respondents (34%) believing this will be a possibility in the future, 28% already seeing their mobile operator as a digital assistant and 33% expecting a highly-personalised service from their mobile operator.

“Today’s consumers in Africa have different set of expectations as they did in the past. They want their mobile devices to be fast and efficient, enabling them to authenticate, book tickets, control gadgets in their home and so much more,” says Sherry Zameer, Senior Vice President, IoT solutions at Gemalto.”The region needs to adapt to these changing expectations which calls for more business collaborations within the mobile market and beyond.”

² “Mobile payments are becoming much more regular in South Africa”, IT News Africa (18 December 2017), available at http://www.itnewsafrica.com/2017/12/mobile-payments-are-becoming-much-more-regular-in-south-africa/.

Sherry Zameer is Senior Vice President, IoT solutions for CISMEA Region at Gemalto