By Tracy Yekaghe

Amidst the burgeoning wave of technological advancements, the financial sector braces for a seismic shift as robotics integration infiltrates bank operations across Nigeria.

RELATED: FirstBank adds first humanoid robot, strengthens commitment to innovative financial solutions for customers

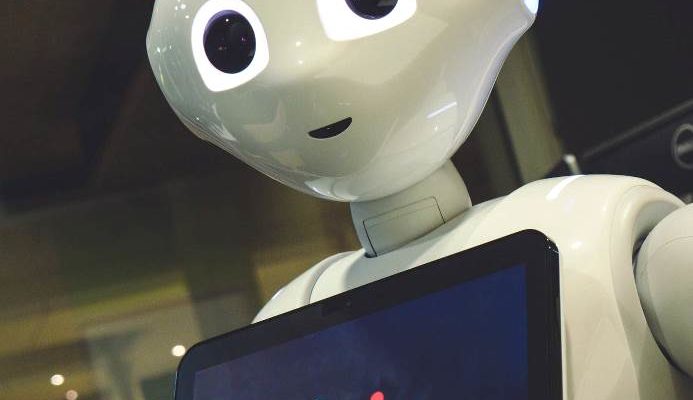

First Bank of Nigeria (FirstBank) has already instigated the revolution with the launch of an industry first humanoid robot at its Adetokunbo Ademola Victoria Island, Lagos Digital Experience Centre (DXC) Branch. The robot is among the phased configuration of the bank’s state-of-the-art digitally led self-service branch. According to FirstBank, “the humanoid robot is equipped with video banking and artificial intelligence (AI), taking on the role of a friendly branch staff.”

For good reasons, the anticipated introduction of robotics into the heart of banking processes has sparked concerns over an imminent and far-reaching wave of retrenchment among bank staff across Nigeria.

It is no surprise that the Managing Director/CEO of FirstBank, Mr. Adesola Adeduntan, made significant efforts during the inauguration of the First Bank Digital Xperience Centre at the UI [University of Ibadan] Branch to assuage the underlying concerns among the bank staff. He assured that the recent advancements would not impact the services rendered by the staff, aiming to dispel any apprehensions.

According to Mr Adeduntan, the days of customers getting stranded inside the banking halls are forever gone with the digital technology of the centre, adding that customers can walk into the location and conduct their banking services without having to interact with any human being.

“There are machines here that issue debit cards, the Robot can help you to make enquiries and you can work with the Robot to open an account. It can also help you block your account in case you suspect any fraud,” said Adeduntan.

The changes are fundamental and could imply that while automation and artificial intelligence loom large, the delicate balance between technological progress and workforce stability hangs in the balance, setting the stage for a transformative upheaval in the banking industry.

The challenge is global and no less frightening in the United States of America. CBS News says about 100,000 banking positions could vanish over the next five years as large U.S. banks invest more in digital banking and other technologies. Bloomberg says robots will cut 200,000 U.S. bank bobs in next decade,

Humanoid robots are here

Humanoid robots are here. Africa made history with the launch December 2, 2022 in Abuja of Omeife, a humanoid robot by Uniccon Group of Companies. The human-like robot was first unveiled 10 October 2022 at GITEX GLOBAL, Dubai World Trade Centre (DWTC), UAE to announce Africa’s entry into the high-skill, high-precision field of robotic engineering; the fusion of biology, behavioural science, and human neuroscience with IT.

Omeife is skilled in language, movement, navigation, and behavioural intelligence using AI and computer vision capabilities. It is a venture that opens a whole new chapter of possibilities for Africa’s march into the fourth industrial revolution (4IR).

What does that mean for the banking industry known to be pacesetters in use of technology? It simply means banks will progressively adopt robots across a broad spectrum of banking operations to alter how customers are served and how services are delivered both at back and frontends by non-human personnel. Banks cannot lag behind in use of technology as dynamics of the financial industry changes and customers get increasingly sophisticated.

As Chairman/CEO of Uniccon Group of Companies, Chukwudi Obinna Ekwueme, puts it: Africa must not miss out on the unfolding opportunities for tech and innovation as well as a humanoid robot market expected to be worth $11 billion by 2026.

Will robots lead to loss of jobs?

The question has remained: Will robots lead to loss of jobs? Yes and No! As the Brookings report noted: “while robots have displaced unskilled workers on assembly lines, they have also created new jobs for machinists, advanced welders, and other technicians who maintain the machines or use them to perform new tasks.”

The report further noted: “Where robots are increasing the efficiency in many businesses, they are also increasing the unemployment rate. Because of robots, human labour is no longer required in many factories and manufacturing plants.”

Indeed “around 4,000 individuals lost their jobs to artificial intelligence in May, 2023 alone according to report by Outlookindia.com.

Yes! It is true “AI is likely to displace some jobs: Certain tasks that are routine, repetitive, or dangerous may be automated using AI. This could lead to job losses in industries such as manufacturing, transportation, and customer service,” GeeksforGeeks reported.

Indeed, the introduction of AI was found to be 28.4% more likely to create jobs than similar investments in other technologies, while it was also 26% more likely to result in job destruction.18 Jan 2022 according to Forbes.

Add all these together, technology is wiping off old ways of doing things and creating new opportunities requiring new skills and a comprehensive approach to upskilling to ensure continuous alignment of these professionals with the evolving demands of industries that include the banking landscape.

The world is not at a standstill. The technology terrain is rapidly evolving and within Nigeria’s banking sector, change is constant. Therefore, skill change or enhancement must also be constant. For those allying themselves to change, there are higher and better engagements including lecturers of Linguistics and other language experts helping to enhance the language contents of AI-powered robots in the banking and other industries.