Executives say they are spending too much time and manual effort on essential processes. Effective back testing is rated as the most important part of the trading infrastructure.

New global research by Beacon Platform Inc. shows that most hedge funds are spending too much time and manual effort on some important risk management processes—and they are willing to switch software vendors to improve the situation.

RELATED: Adoption of digital assets among traditional Hedge Funds records 66.5% jump in 12 months

Technology-leading funds are not being complacent

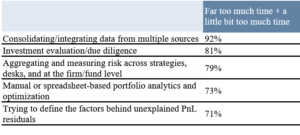

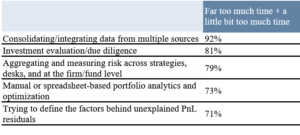

Hedge fund executives see technology as a strong component of their competitive advantage, and they are not being complacent about their capabilities. Even with high levels of system integration, more than 9 out of 10 (92%) of the executives surveyed said that they were still spending too much or far too much time consolidating and integrating data from multiple sources. Investment evaluation and due diligence was selected by 81%, and 79% identified aggregating and measuring risk across strategies, desks, and at the firm or fund level as taking too much time. Yet those rating their system’s competitiveness as excellent were more likely to say these processes were taking too much time than those who rated their system good or average.

Table 1: Thinking about the hedge fund you work for, does it spend too much time and resources on these aspects of portfolio analytics and risk management?

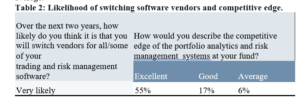

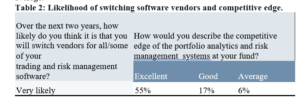

Another surprising difference? While all of the funds surveyed replied that they were likely to switch trading and risk management software vendors over the next two years, more than half (55%) of those rating their system’s competitive edge as excellent said they were very likely to switch vendors, compared to less than 20% of those who rated it as good and just 6% of those who rated it average.

Table 2: Likelihood of switching software vendors and competitive edge.

Back testing becomes more important as funds grow in size

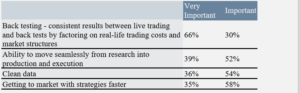

Back testing, specifically producing consistent results between live trading and back tests by factoring in real-life trading costs and market structures, is regarded as by far the most important feature of trading infrastructure, the study by Beacon, the open and customisable developer platform for capital markets, found. Around two-thirds (66%) rated back testing as a very important part of the trading infrastructure, compared with just 39% for the next most important feature, the ability to move seamlessly from research into production.

Table 3: Thinking of the trading infrastructure used by hedge funds today, how would you rate the following features in terms of their importance?

However, the importance of back testing grows significantly with the size of the fund. Only half of the funds with between $500 million and $1 billion assets under management rated back testing as very important, compared with almost 9 out of 10 (89%) of the funds managing between $25 and $50 billion.

Technology is a mixed blessing

Technology is also a source of competitive concern for many C-level execs. Almost 7 out of 10 (69%) felt that advances in technology were making it easier to launch new funds. And 83% of them suspect that some colleagues are planning to leave the company they work for to launch a new fund.

Asset Tarabayev, Chief Product Officer at Beacon Platform Inc. said: “Consistent, cross-asset, real-time views of positions and risks are enabling technology-leading funds to quickly research, refine, and spin up new trading desks and strategies when and where the market opportunities arise.”