Sizeable subscriber adoption of cellular services offered by cable operators alongside escalating high-speed wireless and fiber-optic broadband coverage by telcos is boosting the US fixed-mobile convergence (FMC) revenue, which will see a compound annual growth rate (CAGR) of approximately 2.97%, from $50.8 billion in 2023 to $58.8 billion in 2028, according to GlobalData, a leading data and analytics company.

RELATED: GlobalData forecasts 23.3% revenue growth for private wireless network market

However, GlobalData’s United States Multiplay Forecast-Q3 2023 reveals that total multiplay service revenue in the US will decline at a CAGR of -1.25% from $95.3 billion in 2023 to $89.5 billion in 2028, due in part to cord-cutting and cord-shaving as households migrate away from linear pay-TV in favor of streaming services.

FMC represents households that subscribe to service bundles from a single service provider that include one or more fixed services, like voice, broadband, and pay-TV, plus one or more mobile services. Multiplay service bundles from a single provider are generally built around fixed broadband and may also include one or more additional services such as mobile service, fixed voice, or pay-TV.

Tammy Parker, Principal Analyst at GlobalData, says: “Significant mobile subscriber gains by the nation’s two largest cable companies, Comcast and Charter, have dramatically ratcheted up FMC revenues and household penetration in the US. FMC is also being boosted by the growing adoption of fixed wireless access (FWA) services offered by leading telcos like Verizon, T-Mobile US, and AT&T. Furthermore, Verizon and AT&T are also expanding their fiber broadband footprints, and T-Mobile has entered the fiber fray, offering more opportunities for subscribers to get both home broadband and mobile services from the same carrier.”

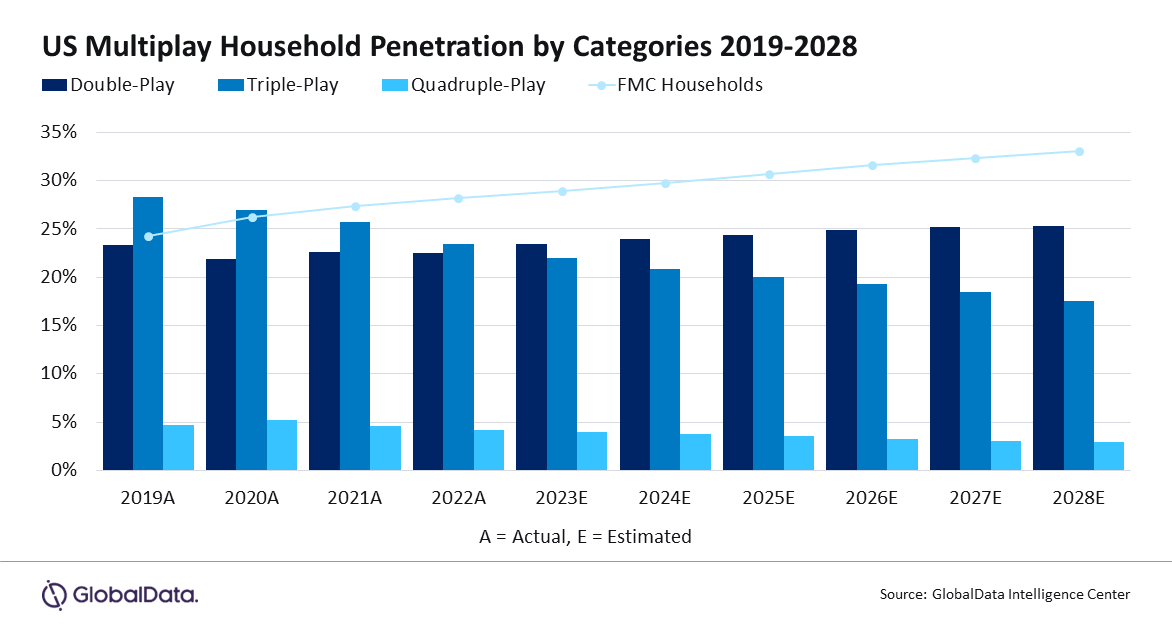

In terms of multiplay offers, doubleplay services will capture the most US household penetration through the forecast period, with slight growth taking doubleplay penetration to the 25% mark in 2028. Tripleplay and quadplay services will continue declining, however, with tripleplay taking the largest hit, dropping from 28% penetration in 2019 to 22% in 2023 and 18% in 2028.

Jesús Romo, Principal Analyst at GlobalData, concludes: “Traditionally, the multiplay strategies revolved around how many services could be offered to the consumer, with quadplay being an expected evolution of the traditional tripleplay of fixed broadband, voice, and pay-TV. However, the focus is shifting to broadband as consumers adopt over-the-top communications, entertainment, and other digital services offered over the Internet. In turn, this is creating opportunities to offer ‘skinnier’ bundles in terms of number of services, but with emphasis on the capacity of that bundle in terms of data speeds or mobile data allowances to offer an ‘always connected’ experience.”