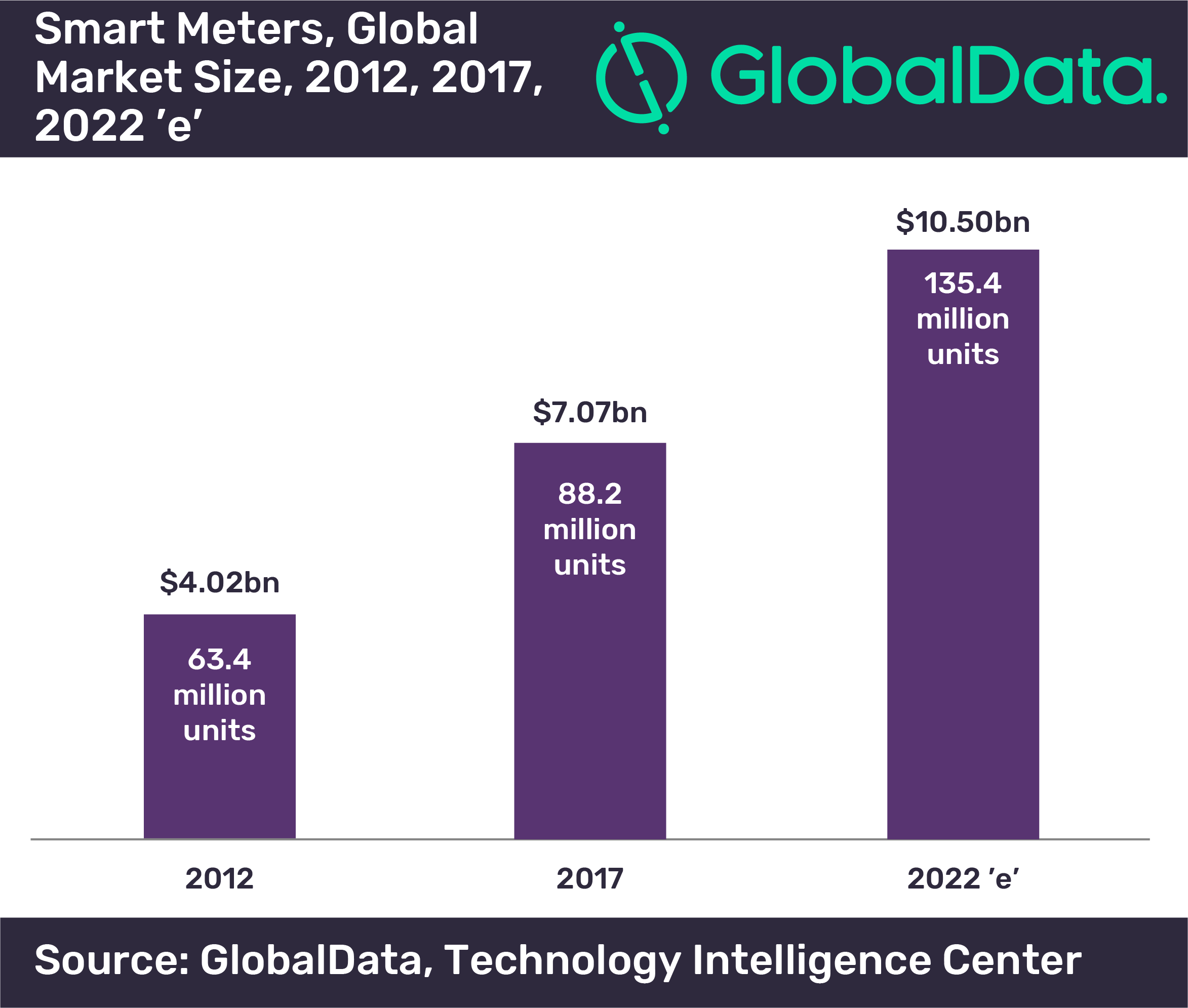

The global smart meter market is estimated to reach $10.4bn by 2022, driven by rising emissions, domestic energy resource constraints, ageing infrastructure and the growing demand and cost of electricity, says GlobalData a leading data and analystics company.

GlobalData’s latest report, ‘Smart Meters, Update 2018 – Global Market Size, Competitive Landscape, Key Country Analysis, and Forecast to 2022’, reveals that nearly 88.2 million installations took place in 2017 where global market value reached $7.1bn. Between 2012 and 2017 global market volume achieved a compound annual growth rate (CAGR) of 6.8% with value achieving double digit CAGR of 12%.

Subha Krishnan, Power Analyst at GlobalData, commented, ‘‘Despite the growth, significant challenges remain such as high meter pricing, lack of supportive incentives, poor meter standards, regulatory shortcomings and resource management. However, as the market grows, it is expected that favorable regulations, cost reduction, and progressive technology development could alleviate some existing challenges.’’

Nations such as the US, South Korea and Japan have issued legislation, targeting 100% market penetration for smart meters. Consequently, the development and large-scale use of renewables, energy management technologies and efficiency measures are expected to contribute to the projected smart meter market growth.

Krishnan continued, “In the forecast period (2018–2022), the market is expected to move at a slightly faster pace, despite several large-scale smart-meter roll-out programs ending or nearing completion. The market volume is expected to register a CAGR of 8.9%, while value should reach a CAGR of 8.2%.”

Market drivers during GlobalData’s forecast period will include, evolving information and communications technology standards, the replacement of outdated meters (both advanced metering infrastructure and traditional), new infrastructure development, and peak load and asset management.

Krishnan adds, “In the forecast period, smart meter installations are estimated to slow down in China which is focused on developing new infrastructure to provide reliable and cheap electricity to support its own economic growth. The US and Japan, owing to their weather resiliency challenges, are focused on creating a more responsive and robust modern day grid, capable of moderating critical system failures.”

ENDS