The global console gaming market continues to grow, with a forecasted revenue increase from $52 billion in 2023 to $79 billion in 2030. As technology evolves, key companies like Sony, Microsoft, and Nintendo are driving innovation through artificial intelligence (AI), cross-platform play, and hybrid devices. However, emerging trends like cloud gaming and remastered titles are reshaping the competitive landscape, according to GlobalData, a leading data and analytics company.

RELATED: Gaming boom loses steam: Equipment sales to experience significant slowdown

Rupantar Guha, Principal Analyst, Strategic Intelligence at GlobalData, comments: “Technological innovation and evolving consumer preferences are driving the progress of console gaming. AI is increasingly used in console gaming, particularly in graphics, game upscaling, and player safety. Cross-platform play is another technology trend that is knocking down the barriers between console ecosystems to improve the playing experience. As technology advances, gaming consoles will continue to evolve, from both a hardware and software perspective.”

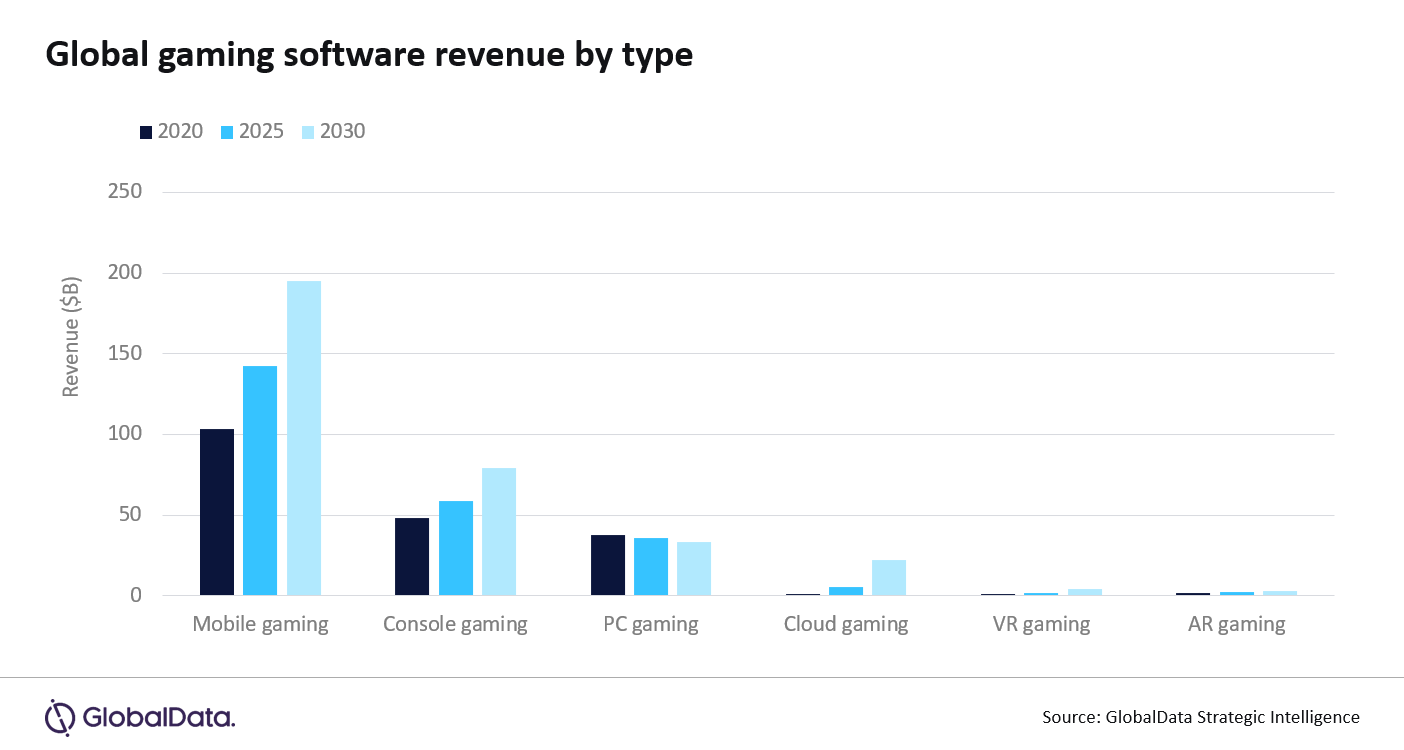

GlobalData’s latest report, “Console Gaming,” reveals that while console games remain one of the two primary segments in the gaming software market, their revenue lags behind that of mobile games, which generate approximately 2.5 times more revenue than console games.

Guha adds: “Console gaming market is fiercely competitive, with Sony, Microsoft, and Nintendo being the dominant companies. In addition, a diverse array of companies—including game developers and publishers, cloud services providers, telcos, retailers, peripheral manufacturers, advertising networks, and payment processors—actively contribute to the market. This variety of companies fosters continuous innovation, making console gaming a dynamic experience for gamers.”

According to the report, the latest generation of consoles from Nintendo, Sony, and Microsoft boast a combined install base of over 250 million units worldwide. Microsoft and Sony will launch new consoles by 2028. These devices will feature better components, high-resolution graphics, cross-platform play, and cloud gaming. Hybrid devices (e.g., Nintendo’s Switch 2, due in 2025) will remain popular thanks to their portability and diverse game libraries.

Cloud gaming can allow gaming companies to reach a broader audience and generate new revenue streams. However, it also has the potential to reduce the demand for consoles, which can disrupt the traditional distribution and revenue models. Sony, Microsoft, and Nintendo are all exploring different cloud gaming strategies with varying degrees of innovation and caution.

Guha concludes: “Game libraries are increasingly populated with remakes and remasters of classic titles. This is a cost-effective way for gaming companies to boost sales, using existing intellectual property (IP) to attract nostalgic gamers and curious new companies. Independent games are another focus area in the console gaming market as they provide creative content at a relatively low cost. Studios proficient in remakes, remasters, and indie games are likely acquisition targets for larger companies.”