Financial technology has helped to transformed the lives of millions of Nigerians and uplifted many from poverty, the Director General of NITDA, Kashifu Inuwa Abdullahi, has stressed in the ongoing 42nd edition of GITEX GLOBAL, now the world’s largest tech and startup show holding in Dubai, UAE.

RELATED: Technology will erode rather than improve democracy without government and regulations, says NITDA boss

According to the NITDA boss, the fact that Nigeria is doing pretty well in the fintech industry; environmental, social and governance (ESG) sector especially in the presence of developmental regulation and enabling policies has helped to create a tech ecosystem that leads the rest of the continent.

Abdullahi was speaking at the Digital Finance Summit, one of the vertical industry sessions at the GITEX GLOBAL. The event equals 33 football fields, 26 halls and 2 million sq. ft to give enough space to the incredible more than 5,000 companies and more than 200, 000 attendees from over 170 countries.

While noting that 2021 was a record year for tech startups in Nigeria as more than 35 percent of direct investments to Africa came to Nigeria, he added that the achievement was not by publicity but by policy design.

His words: “In 2019, the President re-designated and expanded our ministry to cover digital economy and the Honorable Minister of Communications and Digital Economy, Prof. Isa Ali Ibrahim Pantami formulated the National Digital Economy Policy and Strategy for a digital Nigeria; so, that set the stage for the tech ecosystem in Nigeria.”

He said fintech has helped move so many people out of poverty.

“Between 2017 to 2019, we have seen in Nigeria where farmers access money from the government and also, during the COVID-19, a lot of people could not access the released funds and when you deliver it using cash, it costs much.

“The startups are doing fantastically well, but also the government needs to level the playing field for them to plan better,” the NITDA boss said.

He said government needs to work with the United Nations, World Bank and other stakeholders to see how they can help build the infrastructures for the fintech subsector in order to reach the unconnected.

He told the audience that the Startup Bill which has been passed by the National Assembly and awaiting Presidential assent will address almost, if not, all the challenges faced by the tech ecosystem.

Responding to questions regarding Nigeria’s efforts to entrench the ESG, he explained that the Federal Government has been working assiduously towards creating a conducive environment for startups to thrive, as the Ministry of Communications and Digital Economy formulated several policies to help drive the digital economy.

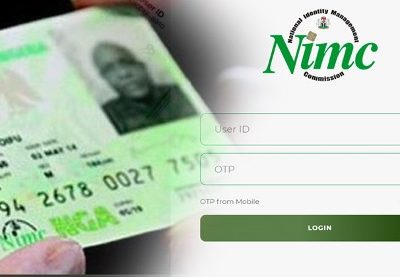

“The policies are Startups ecosystem friendly”, when we talk about digital economy, we need three keys to drive it which include Digital Identity, Payment System, and Connectivity.

“We have other policies is tailored towards the bigger picture, like the National Broadband Plan, Digital Identity Policy, and the National Financial Policy which drives the financial inclusion in the country”, Inuwa maintained.

He said the NITDA’s developmental regulation is to safeguard the providers as much as consumers.

His words: “Without the enabling environment, the ESG alone cannot help them because the ESG sometimes, we see it as self-centric because as a provider when you come up with any self-regulation or ESG, you do it in a way that would enable you to excel”

“The government looks at technology beyond seeing just a capitalist or a consumer, we work with the ecosystem in a way that gives them opportunity to develop new indigenous solutions that have global impact.”