Speculation and fear that the much-discussed AI ‘bubble’ might be on the verge of bursting is gripping investors worldwide following major turbulence in global stock markets last week.

RELATED: Bitcoin is better inflation hedge than gold, says deVere CEO

However, the CEO and Founder of one of the world’s largest independent financial advisory and asset management organizations, believes it’s too early to call.

Nigel Green of deVere Group says: “Fear mongers are pointing to the sharp declines in the stock prices of leading AI companies like Nvidia, Google, and Microsoft as evidence of a looming slowdown.

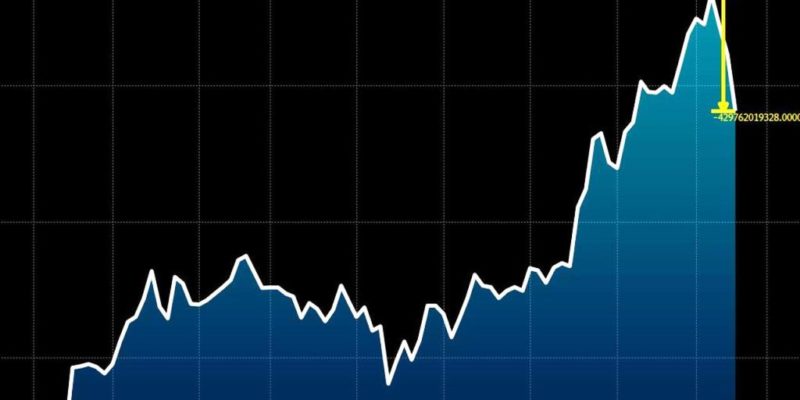

“Nvidia, a company that has become almost synonymous with the AI revolution, saw its stock plummet by as much as 15% last week, leading some analysts to prematurely declare the beginning of the end for the AI boom.

“But this narrative is not only premature, it also overlooks the profound and enduring impact of AI technologies, particularly generative AI, on the global economy.”

Over the past year, companies deeply invested in AI have seen their stock values soar to unprecedented heights. Nvidia, whose cutting-edge GPUs are the backbone of AI infrastructure, has experienced a meteoric rise, with its stock price more than tripling since last summer.

This explosive growth has led to concerns that the market is inflating beyond sustainable levels, reminiscent of the dot-com bubble of the late 1990s.

Critics argue that such rapid increases in stock price, especially when they appear disconnected from the immediate generation of tangible value, often signal that a correction is imminent.

But is this really the case with AI?

“To label the current AI landscape as ‘overhyped’ – as one hedge fund manager has done – is to fundamentally misunderstand the nature of the technological advancements at play,” notes Nigel Green.

“Generative AI, in particular, is not just a fleeting trend; it is a revolutionary force that is already reshaping industries and will continue to do so for decades to come.

“Nvidia, with its state-of-the-art hardware and software solutions, is at the heart of this transformation. The company’s GPUs are critical for training large AI models that power generative AI applications.

“As businesses and developers continue to explore the vast potential of AI, Nvidia’s role as a key enabler of this technology is only set to grow. The company’s stock price fluctuations should not be viewed as a sign of weakness or overvaluation but rather as part of the natural ebb and flow of a market that is still coming to grips with the full implications of AI.”

Despite recent market jitters, the broader trends in AI adoption tell a different story. Companies across industries are increasingly integrating AI into their operations, driving innovation and unlocking new value.

In healthcare, AI is revolutionizing diagnostics and personalized medicine. In finance, AI algorithms are enhancing risk management and fraud detection. In manufacturing, AI-powered automation is boosting productivity and reducing costs. These are not speculative applications—they are real, tangible examples of AI’s impact.

The deVere Group CEO continues: “The potential of AI is far from being fully realized. The ongoing development of more advanced AI models, the refinement of machine learning techniques, and the expansion of AI-driven services are all indicators that we are still in the early stages of a long-term technological shift.

“As AI continues to evolve, it will unlock new possibilities that we cannot yet fully anticipate, further cementing its role as a cornerstone of the future economy.”

He concludes: “It’s far too early to declare the AI boom as overhyped or unsustainable.

“The recent dips in stock prices should be seen as opportunities for investors to capitalize on the long-term growth potential of AI, rather than as signs of impending doom.

“The narrative of an AI ‘bubble’ bursting is one that fails to account for the profound and lasting changes that AI is bringing to the world.”