Get ready to transform your digital marketing strategy! linkdaddyseo.com has conducted an in-depth study that unveils invaluable insights and projections for the global digital marketing landscape in 2023.

RELATED: Digital Ad spend to reach $753b globally in 2026, driven by in-app advertising

The market size is determined by a survey conducted by linkdaddyseo.com, employing a combined top-down and bottom-up approach. The forecasting process incorporates various techniques tailored to the market’s behavior. For instance, the S-curve function is utilized for forecasting digital products due to its ability to capture the non-linear growth pattern associated with technology adoption.

Online advertising to reach 68.5% by 2023; surpassing 70% by 2025

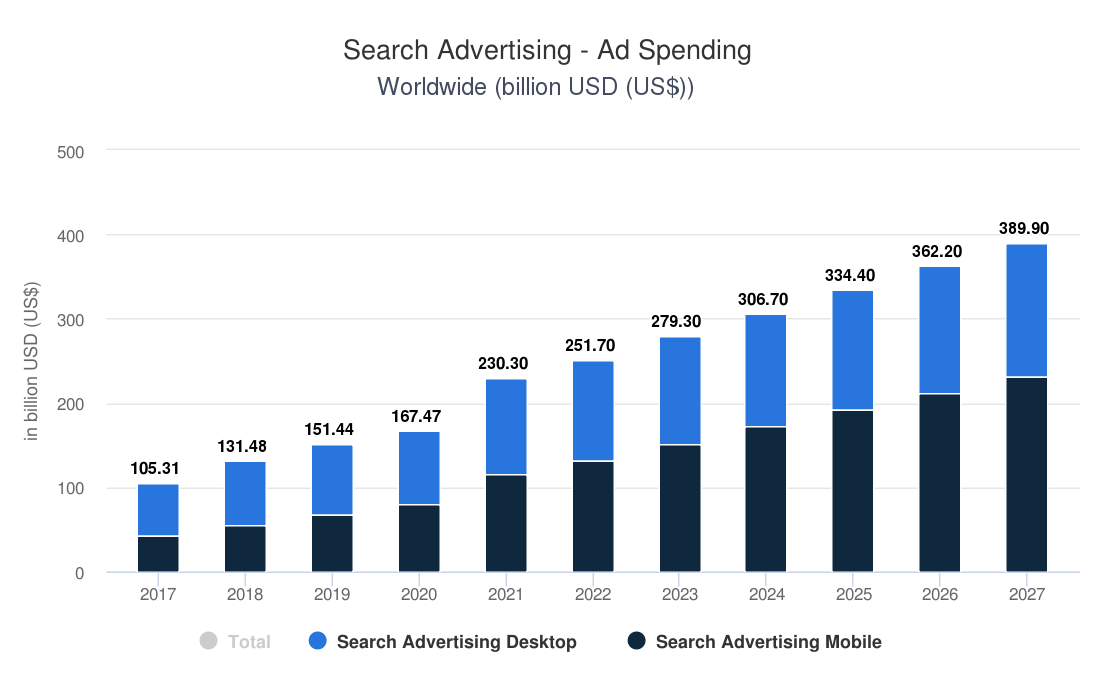

expected to grow substantially, potentially reaching 68.5% by 2023 and surpassing 70% by 2025. This prediction is in line with the key findings related to search advertising. In 2023, ad spending in the Search Advertising market is projected to reach US$279.30 billion. It is anticipated to show an impressive annual growth rate (CAGR) of 8.69% from 2023 to 2027, resulting in a projected market volume of US$389.80 billion in 2027. In a global comparison, the United States is expected to generate the majority of ad spending, with a contribution of US$118.20 billion in 2023.

Furthermore, in 2027, it is predicted that US$231.80 billion of the total ad spending in the Search Advertising market will be generated through mobile platforms. The average ad spending per internet user in the Search Advertising market is projected to amount to $52.39 in 2023. Google remains a dominant player in this sector, holding an estimated market share of 58% in the Search Advertising market for the selected region in 2022. From 2023 to 2027, search advertising is expected to increase by 39.6%.

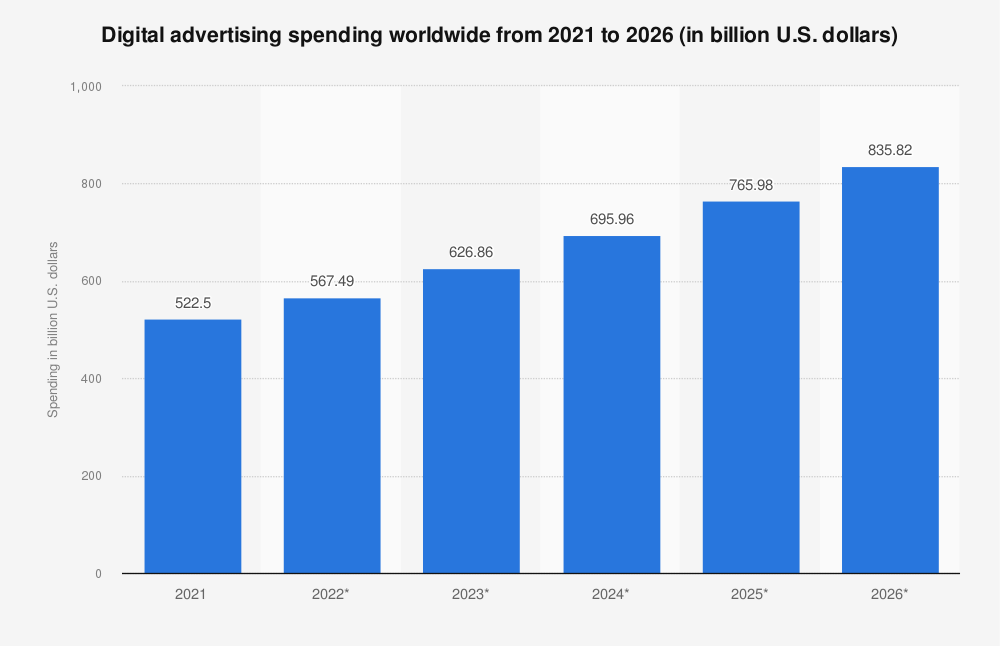

Digital advertising spending worldwide from 2021 to 2026 (in billion U.S. dollars)

Digital advertising spending worldwide amounted to 626.86 billion U.S. dollars in 2023. By 2026, the spending is projected to reach 835.82 billion dollars. The growth rate in the period 2022 to 2026 will be 47.28%. However, the growth will gradually drop to roughly nine percent in 2026.

Global advertising spending has been constantly increasing (except in 2020) since 2010. However, due to technological advances and consumer preferences, not all media are as heavily invested as others. In 2022, the Internet was considered the most important medium for advertisers, accounting for 62 percent of total media ad spend in 2022. Internet expenditures are projected to record a growth rate of 8.4 percent until the end of 2023.

Digital advertising spending worldwide, including desktop and laptop computers and mobile devices, stood at an estimated 522.5 billion U.S. dollars in 2021. 567.49 billion U.S. dollars in 2022, with an increasing rate of 8.61%. This figure is forecast to constantly increase in the coming years, reaching 835.82 billion U.S. dollars by 2026.

Mobile internet ad spending to increase to $495 $billion in 2024

Mobile internet advertising is a heavily invested sub-sector of the digital advertising industry. Mobile internet advertising spending is forecast to increase from 276 billion U.S. dollars in 2020 to nearly 495 billion U.S. dollars in 2024. Following this pattern, mobile advertising spending in the U.S. is also forecast to grow in the coming years. Mobile ad spending in the U.S. will reach nearly 25 billion U.S. dollars in 2023.

In 2022, digital advertising accounted for 67 percent of total ad revenue worldwide, according to the forecasts. Moreover, the share of online advertising might grow to 68.5 percent in 2023, surpassing 70 percent in 2025.

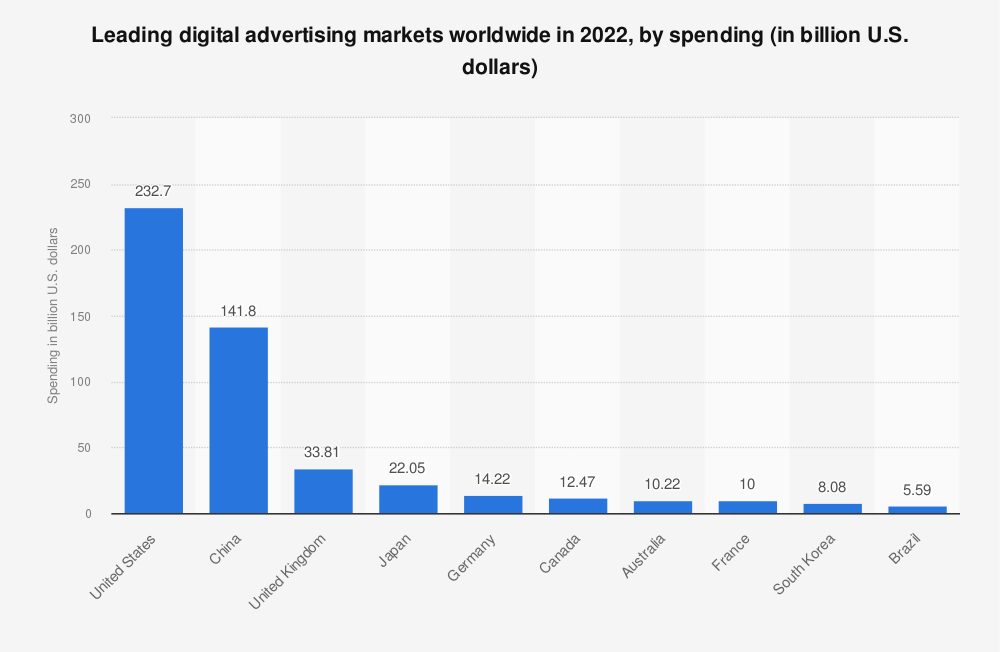

Leading digital advertising markets worldwide in 2022 by spending (in billion U.S. dollars)

China’s total digital advertising spending was nearly 142 billion U.S. dollars at the end of 2022, behind the U.S. with approximately 233 billion dollars.

The data is based on ad spending from domestic companies within the selected market, regardless of where an advertisement is displayed.

E-mail marketing, audio ads, influencer marketing or sponsorships, product placement, and commission-based affiliate systems are not considered here.

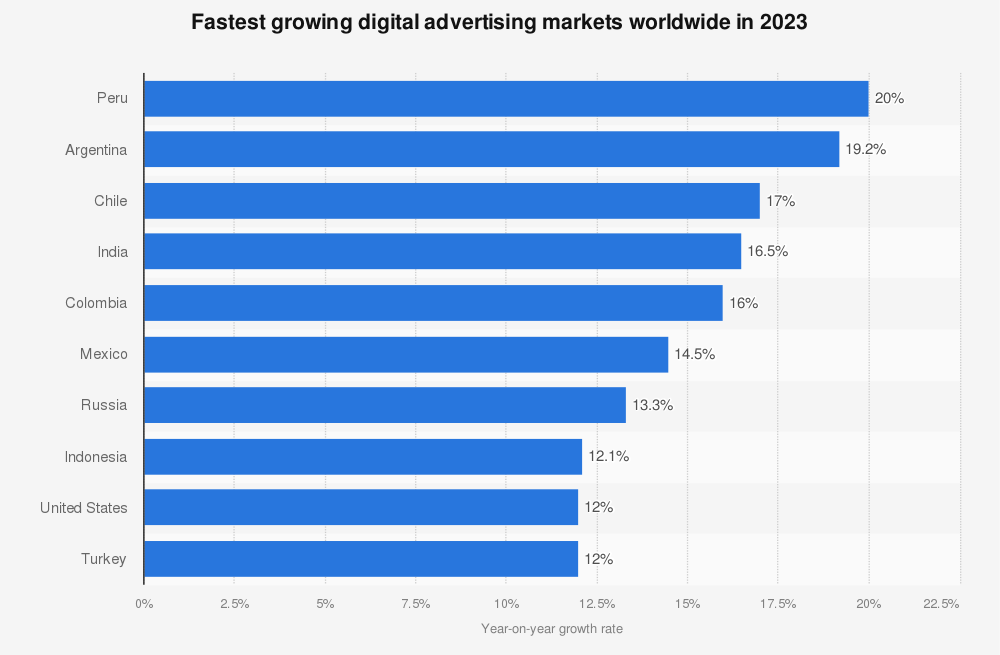

Fastest growing digital advertising markets worldwide in 2023

In 2023, Peru is expected to be the fastest-growing digital advertising market in the world, with an annual growth rate of about 20 percent. Argentina and Chile rounded out the top three yearly increases with approximately 19 and 17 percent, respectively. The United States is the 9th fastest-growing digital advertising market worldwide, with annual increases of roughly 12%.

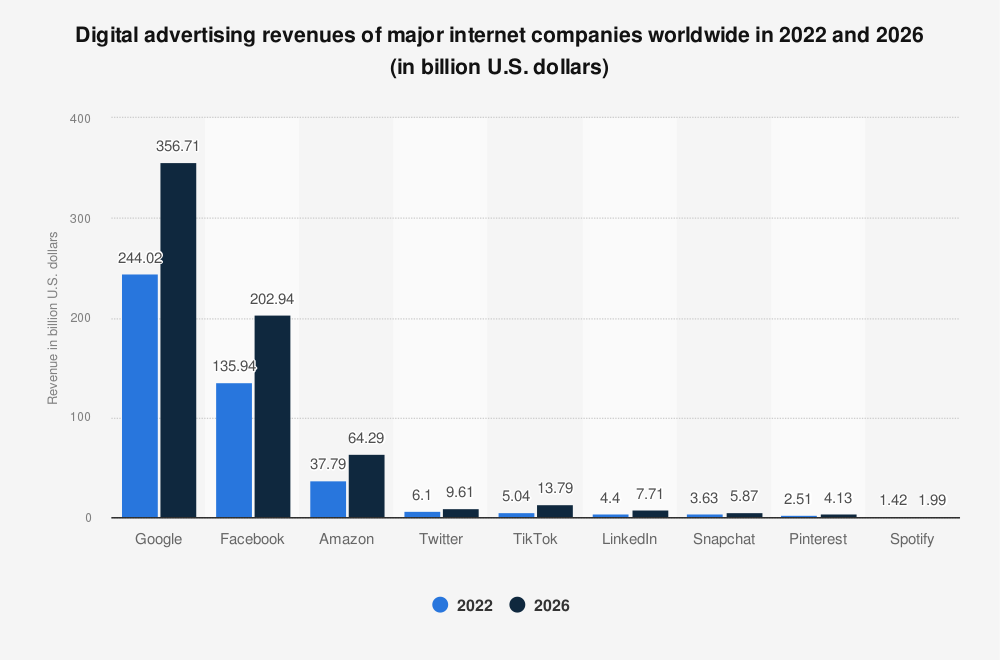

Digital advertising revenues of major internet companies worldwide in 2022 and 2026 (in billion U.S. dollars)

In 2022, Facebook’s digital advertising revenues saw the Meta company generate 136 billion and were projected to reach 202.94 billion U.S. dollars by the end of the fiscal year 2026. TikTok was projected to see its online advertising revenues hit 13.79 billion U.S. dollars in 2026. By comparison, Google’s advertising revenues are forecast to reach approximately half of $356.71 billion in 2026. The growth rate will be 46.18% by 2022.

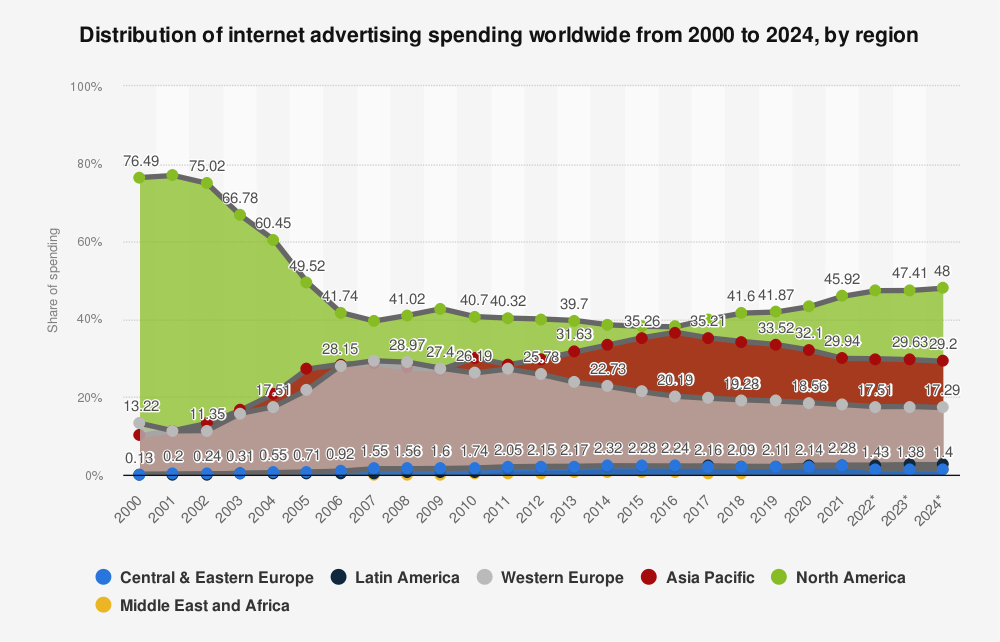

Distribution of Internet advertising spending worldwide from 2000 to 2024 by region

Latin American expenditures are forecast to account for 2.48 percent of global internet advertising spending in 2022. Moreover, internet ad spending in North America is expected to contribute 47.37 percent in the same year.

Spending on internet advertising in North America amounted to nearly 192 billion U.S. dollars in 2021. According to forecast data, online ad expenditures in the region will suffer less than other media in light of the coronavirus outbreak in 2020 and will rebound by 2024 to reach 269 billion dollars.

In 2022, search advertising was the most invested-in digital advertising format in North America, attracting 94.38 billion U.S. dollars in Canada, Mexico, and the United States.

Search Advertising Ad Spending Worldwide 2017 – 2027

The data shown uses current exchange rates and reflects the market impacts of the Russia-Ukraine war. Search advertising is expected to increase by 39.6% in 2027 compared to 2023.

The development of the internet infrastructure and the decreasing prices of internet-enabled devices such as PCs and smartphones are the main causes of the growth in search advertising.

The Internet infrastructure has seen tremendous transformation in the past ten years and is now quicker and cheaper. In addition, because internet-enabled devices have become more affordable, allowing more people to purchase and use them daily, search advertising is expected to grow significantly.

Before the COVID-19 pandemic, search advertising showed signs of steady and consistent development. However, the pandemic has accelerated digital adoption, resulting in exponential growth in search advertising, especially on marketplace platforms.

Even though data privacy regulations have been tightened globally and search engine platforms have taken steps to emphasize the importance of privacy, these platforms have already found a way to collect data in a more ethical and consent-based manner. In the coming years, we anticipate steady growth in search advertising across search engines and marketplace platforms.

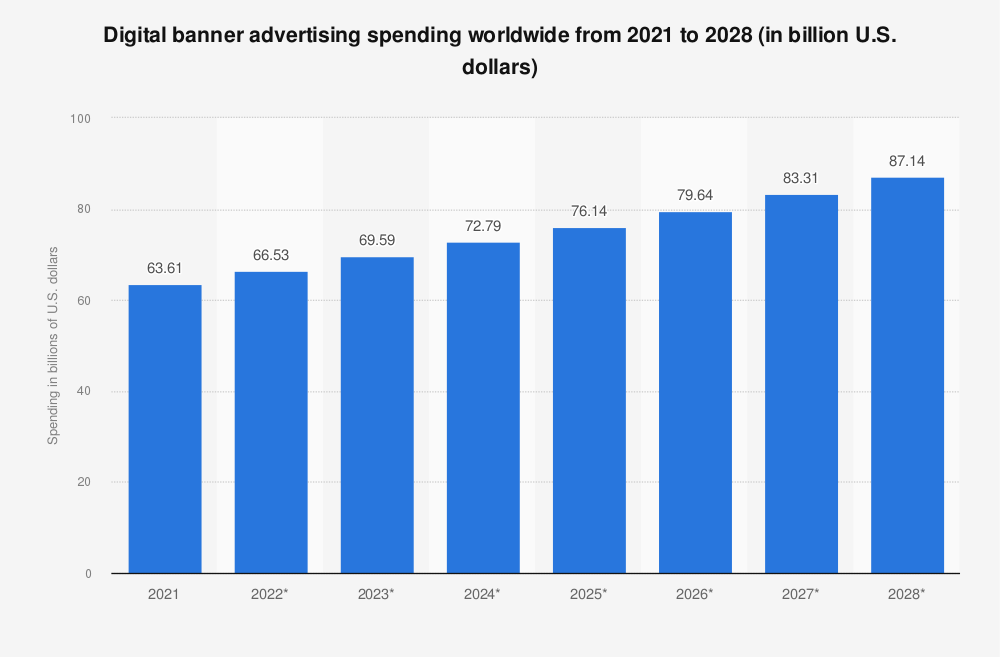

Digital banner advertising spending worldwide from 2021 to 2028

Global banner advertising spending stood at roughly 67 billion U.S. dollars in 2022. According to the study, it’s forecasted that the figure will increase annually at a growth rate of approximately 4.6 percent until 2028, when it is expected to exceed 87 billion.

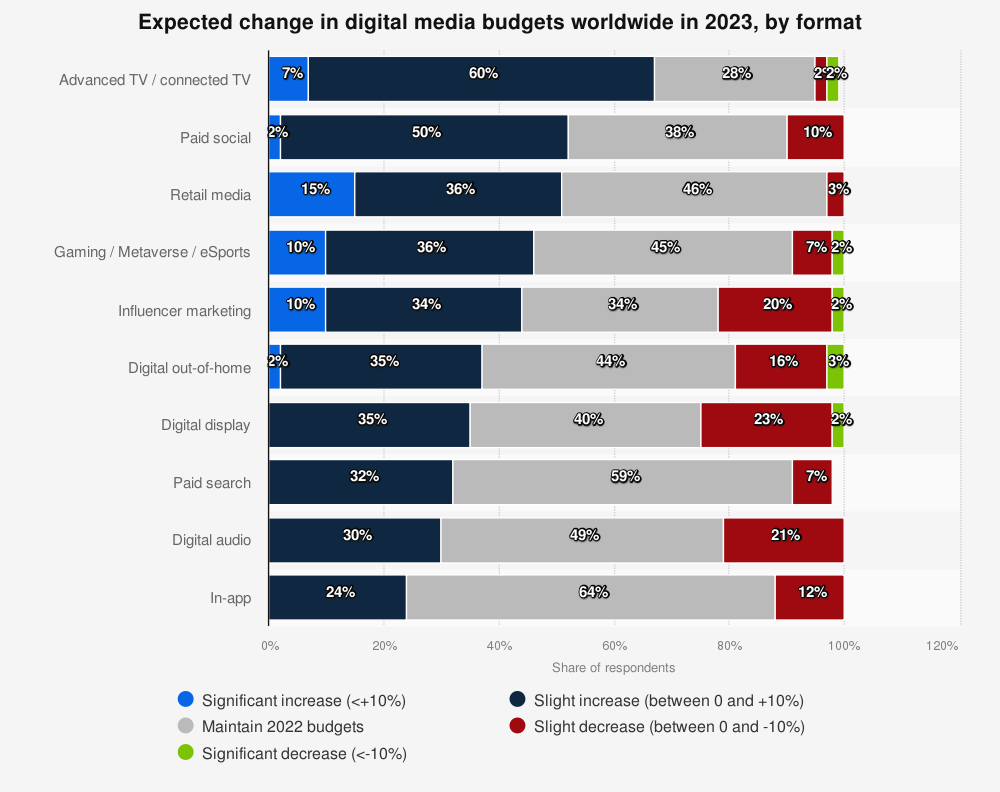

Expected change in digital media budgets worldwide in 2023 by format

The survey was conducted among 43 global brands, depending on the format. Ten percent of responding international brands stated they plan to increase their retail media budgets significantly in 2023. Another 36 percent said they were planning to raise them slightly. The 43 global brands surveyed had a collective annual advertising spending of 44 billion U.S. dollars.

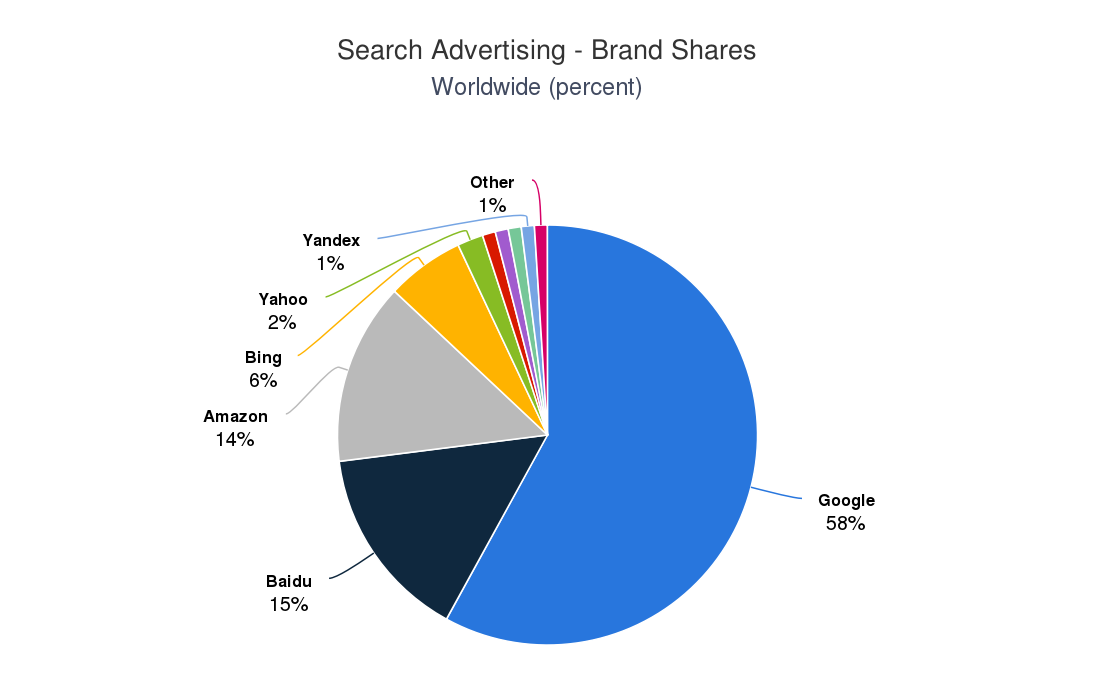

Search Advertising Brand Shares

There are currently six major search engines, four of which are international: Google, Bing, Yahoo!, and DuckDuckGo. Yandex focuses on nations that speak Russian, while Baidu focuses on countries that speak Chinese. Due to its massive user base and effective internal advertising network, Google is by far the most popular among advertisers, with a 58% share.

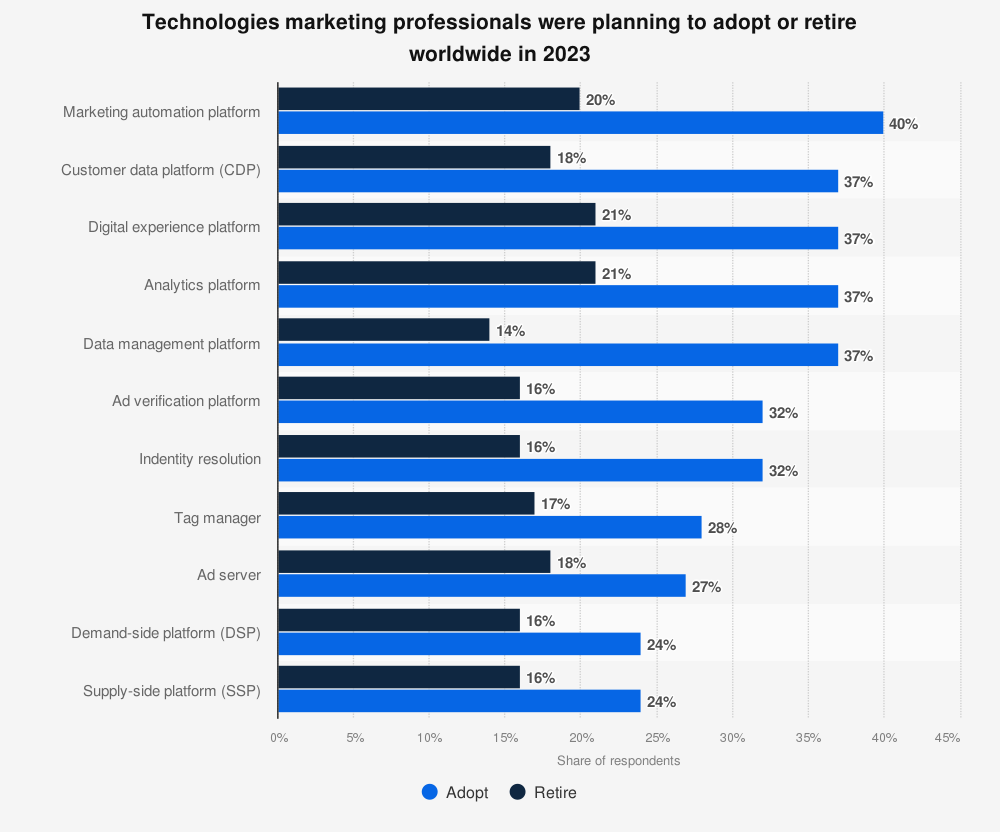

Technologies marketing professionals were planning to adopt or retire worldwide in 2023

Forty percent of responding industry professionals, marketers, and publishers from Australia, Colombia, India, Mexico, Singapore, the United Kingdom, and the United States stated that they were planning to adopt a marketing automation platform in the following six to 12 months, whereas 20 percent said they were planning to retire that technology.

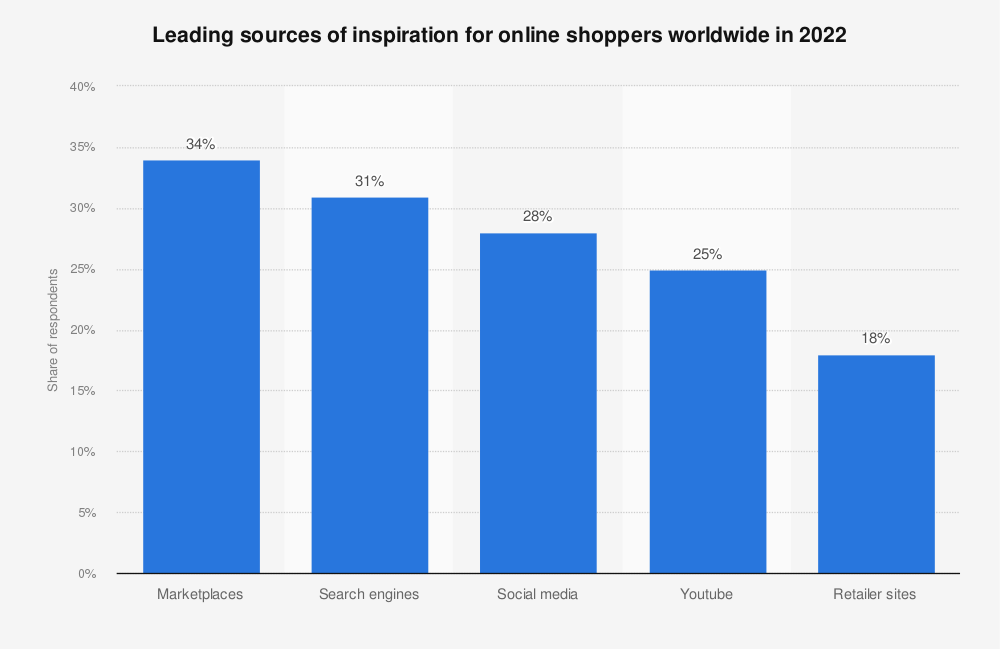

Leading sources of inspiration for online shoppers worldwide in 2023

The survey was conducted online on April 28, 2023, with 31,040 respondents aged 16 and older, consumers who shop online at least once a month; Online interviews. In 2023, marketplaces will be the primary source of inspiration for online shopping globally. According to a survey, approximately 34 percent of online shoppers sought inspiration through searches on this channel. Search engines ranked second, with one-third of respondents using them.

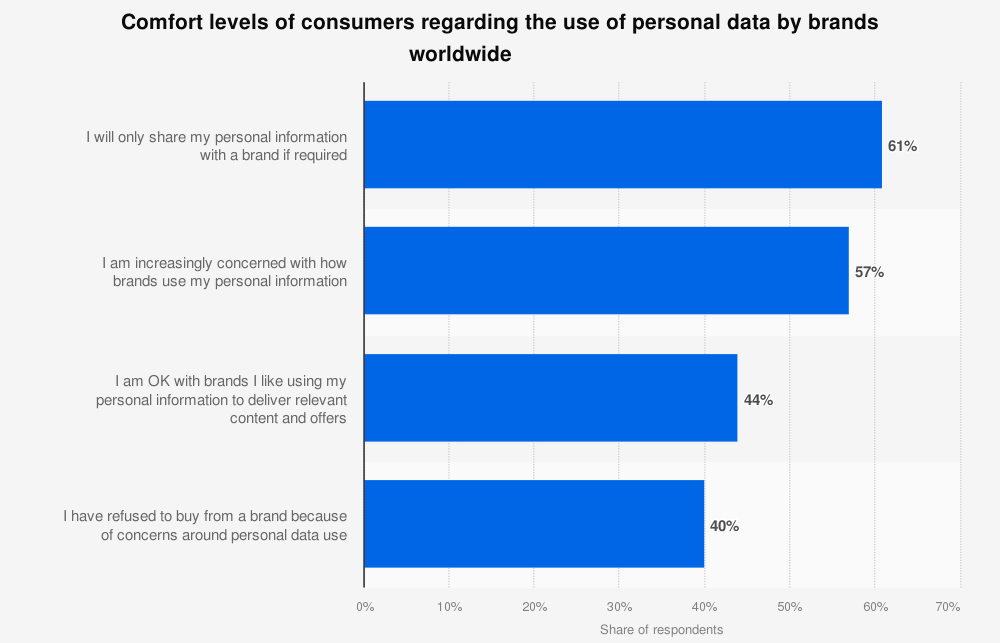

Comfort levels of consumers regarding the use of personal data by brands worldwide in 2023

When asked about brands and how they use consumer data to create personalized shopping experiences in 2023, approximately six in ten consumers worldwide said they typically only shared their personal information with a brand if it was required to proceed; nearly the same respondents said they are becoming increasingly concerned with how brands use their data. Overall, many people would rather avoid sharing their information for personalization.

The complete study and detailed methodology are at linkdaddyseo.com.

COVER IMAGE: Descript