By Kendall Russell

As satellite operators expand their footprints into new verticals and customer bases, the key to long-term sustainability will be integration with the broader telecommunications ecosystem. During the Tuesday opening session at the SATELLITE 2018 Conference & Exhibition, the executive leaders of five of the largest global satellite operators agreed that the future of wireless communications will be multi-faceted — with satellite and terrestrial networks operating seamlessly side-by-side within a range of markets.

Rodolphe Belmer, Chief Executive Officer (CEO) of Eutelsat, said the next stage of transformation for his company will include major partnerships with big telcos. “We were an industry based on silo benefits — TV, government service, large quantities of data for companies operating in remote areas — and now we’re moving to position ourselves as a complement to telecommunications companies, to expand their benefits beyond the footprint of their terrestrial networks,” he said.

Intelsat CEO Stephen Spengler echoed Belmer’s comments, noting that satellite naturally complements other wireless technologies due to its ubiquity, security, quality of service, and point-to-multipoint capabilities. “On top of that, with the massive investment and innovation we’ve seen in recent years, we’ve made tremendous strides in terms of the performance and economics of our services. You look at all of that and it says we’re ready to participate in the broader network,” Spengler said.

Spengler’s perspective falls in line with Intelsat’s intent to create a new spectrum sharing paradigm alongside Mobile Network Operators (MNOs), a viewpoint shared by SES. Ultimately, the company’s goal is to find a “pragmatic approach” to preserving C-band spectrum for widespread satellite applications, while also reducing tension between the two wireless factions.

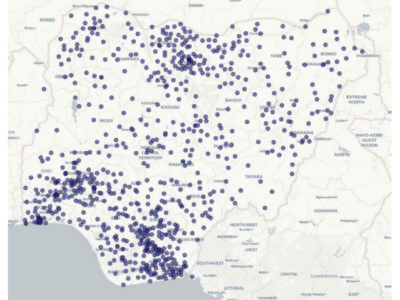

Networking at SATELLITE 2018 in Washington DC. Samson Osagie., ED, Marketing Nigcomsat Ltd and officials of Turksat AS

This sort of collaboration will become increasingly important as satellite companies and telcos converge into the same markets. Passengers riding in connected cars or streaming Netflix on a plane don’t care whether they’re using satellite or some other connectivity source — they only want it to be “indistinguishable from the other network elements that they use,” said Telesat CEO Daniel Goldberg. As a result, implementing a standards-based architecture across different technologies will be critical to ensuring these connections play together seamlessly in varying environments. “We’re going to have a much more hybrid, integrated architecture in the future,” Goldberg said.

According to Spengler, accelerating this evolution in ground technology was the motivation behind its partnership with electronically steered antenna manufacturer Kymeta. “One of the reasons we’ve made an investment in Kymeta is to try to stimulate the antenna sector,” he said. “The form factor, performance, size and cost has to get there. We’ve done a good job of building high throughput in space but there’s more to it.”

“Coming up with a satellite that’s hugely capable and then adding ground infrastructure that’s not designed to work hand in glove with that space segment is a massively missed opportunity,” added Goldberg.

Figuring out the right approach to ground infrastructure raises an important question for satellite operators: Is it better to vertically integrate and design an end-to-end system independently, or is that an exercise in redundancy given existing ground segment providers’ expertise? Apparently, it depends on who you ask. Telesat, which is on the verge of deploying a new constellation into Low Earth Orbit (LEO), relies heavily on its downstream partnerships and has no intentions of moving closer to its end users, Goldberg said. “We’re undertaking a hugely ambitious project … and for us to bring forward a new disruptive infrastructure [would] take all our energy and resources,” he said. “Trying to leapfrog over our existing customers and partnerships would ignore and diminish the value that they bring to the table.”

Eutelsat’s Belmer spoke similarly, noting that the company’s primary focus is maximizing the fill rate of its satellites. “For the business of tomorrow we believe that only one application will not be enough to fill satellites. We will have to have diverse sources of revenue and it calls for working with distributors who specialize in each niche of business,” he said.

This approach does have its downsides, however. Namely, too much fragmentation could lead to a disconnect from end users’ actual needs, warned SES’ new CEO Steve Collar. The satellite industry has suffered from this in the past — and it may be part of the reason why top line growth in recent years has plateaued. “The most important thing for all of us is to really understand what the source of demand is,” Collar said. “If we don’t understand what’s going on with the end users — with the customers whose demand we’re filling — shame on us.”

Belmer admitted that stock prices for satellite companies are relatively depressed these days, and attributed the decline of investor interest to the industry’s inability to generate meaningful cash flow. Some financiers have soured on satellite because many companies have not been able to cover the dividends they promised their shareholders, he said. The next step for Eutelsat, then, is to prove that its legacy businesses, such as video, can remain profitable. At the same time, the company will experiment with new applications expected to grow steadily for the foreseeable future, such as mobility.

Belmer noted that he is quite positive about the dynamics of the video segment for satellite. “The revenues are very robust and the profitability is good. When we look at the penetration of the service among households in the world, it’s growing everywhere but the U.S., meaning we are sitting on a very solid, predictable business,” he said. “It’s going to continue likewise for the foreseeable future.”

The massive upswell of private capital that has flooded the NewSpace environment reflects the potential investors see in the satellite industry. Whether traditional operators can trigger the same kind of optimism remains to be seen — but it’s clear that new applications such as mobility and the Internet of Things (IOT) are an attractive target. “You can’t downplay the demand. We all feel there are tremendous opportunities to unlock if we get the formula right,” Spengler said.

Originally published in Via Satellite.