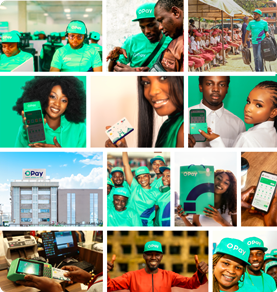

ChitChat, a leading African social commerce platform, has announced the launch of its new remittance feature. This will enable seamless cross-border money transfers across 13 countries worldwide. This feature expands the financial services users can access from within a chat conversation. It also increases the functionality of the multicurrency ChitChat wallet and USD virtual debit card.

RELATED: E-commerce landscape in Africa: Trends and Insights

ChitChat is a social commerce platform that enables users across Africa to chat with each other over an encrypted platform. The platform is built with security and effortless financial transactions in mind. It enables users to send instantaneous USD payments to friends and family within chat conversations.

New feature expands markets for users

The new remittance feature expands the markets from which users can send and receive funds. All received funds can be converted to local currency within the app. Users can send money to bank accounts, mobile wallets, and cash agents in several countries. ChitChat aims to provide users with a safe and secure place to chat, transact, send and receive money, and create communities.

For its initial phase, the supported remittance destinations include developed and growing markets like India, Japan, China, and the United States. Others are the United Kingdom, Canada, Malaysia, South Africa, Tanzania, Zimbabwe, Zambia, Ghana, and Rwanda.

Remittances are a crucial source of external finance for many African households with contributions exceeding 20% of GDP in some countries. In 2022, remittances to Africa reached $100 billion, surpassing the combined total of development assistance and FDI into the continent. With this new addition, ChitChat aims to make financial transactions easier for Africans living abroad. The app is domestically supporting family members and conduct business.

“We are thrilled to introduce remittances as the latest offering on the ChitChat platform. This feature allows Africans at home and abroad to send money easily and securely. Whether it’s a bank deposit to the UK, a mobile wallet transfer to Zimbabwe, or a cash payout in Ghana, we aim to provide a smooth and accessible service for all,” said Perseus Mlambo, CEO of ChitChat.

Future updates will include group wallets inside group chats, further establishing ChitChat as the preferred platform and leading homegrown solution for all communication, commerce, and financial services.