This article by Electroneum offers insight on how crypto and blockchain adoption for financial inclusion could salvage over 250 million people across the globe that may be plunged into extreme poverty as a result of Covid-19.

While the Covid-19 crisis has reversed the recent global poverty reduction, according to the UN and other experts, it has also sped up financial inclusion via mobile financial services apps provided by crypto, blockchain and FinTech startups.

Many people worldwide take for granted the services billions of others struggle to access. Stop and close your eyes for just a moment and imagine yourself without access to financial services like opening a bank account, getting a debit or credit card, or a small loan to improve living standards, launch a small business or send children to school.

In their book “Financial Exclusion and the Poverty Trap,” authors Pamela Lenton and Paul Mosley assert that one of the main causes of poverty is financial exclusion, which they define as the inability to access finance from mainstream banks.

In a description of Lenton and Mosley’s book, the publisher Routledge says that “people on low or irregular incomes typically have to resort to loan sharks, ‘doorstep lenders’ and other informal credit sources, a predicament which makes escape from the poverty trap doubly difficult.”

The Global Finance news outlet took that definition a bit further by saying that financial exclusion undermines the quality of life of hundreds of millions of people globally who have no checking or savings bank account. And they add: it holds back their nations’ economies as well.

Is the unbanked a developing nations’ issue only?

The vast majority of financially excluded individuals live in developing regions. But the financial exclusion problem isn’t a developing world exclusive, says a World Economic Forum (WEF) report.

The US Federal Reserve found that 22% of adults in the United States are either unbanked or underbanked. That’s roughly 63 million people. The UK’s Financial Conduct Authority released a study in which they estimate that 1.3 million United Kingdom adults were unbanked in 2019.

READ: ETN-Network CEO to debate blockchain for social impact at Blockchain for Europe Summit 2021

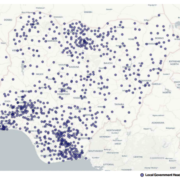

The developing nations’ financially excluded, however, are also a young and largely tech-savvy population. In parts of Africa, for example, mobile phones are more common than access to electricity. This is mirrored by the population in many developing countries. A tech-savvy population with a high mobile phone penetration rate and a pressing need for financial services create the perfect conditions to accelerate the adoption of cryptocurrencies.

And then came Covid-19

Along came Covid-19 with arguably contrasting results. On the one hand, United Nations University (UNU) researchers assure that the health crisis could push as many as 500 million people into poverty, or 8% of the world’s population.

This would be the first time that poverty has increased globally since 1990. The UNU study adds that the achievement of the 2030 Agenda, and in particular, the UN’s Sustainable Development Goals on no poverty and zero hunger, is under considerable threat.

The United Nations estimates that by 2030, an additional 207 million could be pushed into extreme poverty due to the severe long-term impact of the coronavirus pandemic. That will bring the total number of people in extreme poverty to more than a billion, a UN Development study revealed.

In October 2020, the World Bank said that for the first time in 20 years, global extreme poverty is expected to have risen as the Covid-19 disruption compounds the forces of conflict and climate change, which were already slowing poverty reduction progress.

The World Bank report adds that had the pandemic not affected globally, the poverty rate was expected to have dropped by 7.9% last year. Instead, by the end of this year, about 150 million more people will find themselves in extreme poverty, the global financial institution added.

“The convergence of the COVID-19 pandemic with the pressures of conflict and climate change will put the goal of ending poverty by 2030 beyond reach without swift, significant and substantial policy action,” the World Bank stated.

However, the number of people pushed into poverty could be greater. An Azim Premji University (India) released a report in May 2021 saying the pandemic had actually increased India’s poverty population by 230 million.

Before the pandemic, about 60% of India’s nearly 1.3 billion people live on less than $3.10 a day, the World Bank’s median poverty line. Just over 21%, or more than 250 million people, were surviving on less than $2 a day.

Is there a silver lining to Covid-19 for financial inclusion?

Global Finance said if there is a silver lining to the current health crisis, it would be that “there are already signs the Covid-19 pandemic could turn into a powerful booster of financial inclusion everywhere. Over the past year, a record number of new accounts have been opened worldwide by firms providing mobile money, FinTech firms, and online banking services.”

The International Monetary Fund (IMF) appears to have agreed in a blog post dated July 2020 where it predicted that the “COVID-19 pandemic could be a game-changer for digital financial services. Low-income households and small firms can benefit greatly from advances in mobile money, FinTech services, and online banking.”

The IMF also found that extending traditional financial services to low-income households and small businesses is directly linked to increasing economic growth and reducing income inequality. “Our analysis finds that digital financial inclusion is also associated with higher GDP growth,” the IMF added.

In a December 2020 article, the World Bank said “access to affordable financial services is critical for poverty reduction and economic growth. For poor people, especially women, access to and use of basic financial services can raise incomes, increase resilience, and improve their lives.”

Blockchain for financial inclusion

Internationally recognised blockchain advocate and speaker, Dr. Jane Thomason of Fintech Worldwide explains how advances in digital technology can be harnessed to meet the UN’s Sustainable Development Goals.

“Blockchain was highlighted as one of the technologies that will accelerate progress towards the SDGs,” said Dr. Thomason. “Blockchain-based digital identity can unlock many barriers faced by the poor, as well as facilitate greater economic growth through ease of transactions. Once a person has an identity, they can potentially have access to a range of services.”

She gave a real-world example: “Humanitarian organisations, like the World Food Programme, are deploying blockchain in refugee camps to address a multitude of issues beyond digital identity: cash transfers and remittances, the integrity of donor fund flows, property registry, employment rights, human trafficking, education, and asylum-processing.”

Based on a joint study by the World Bank, University of Cambridge, and World Economic Forum, the FinTech projects (many of which are blockchain-powered) have continued to help expand access to financial services during the Covid-19 pandemic—particularly in emerging markets—with strong growth in all types of digital financial services except lending.

A blockchain startup fights financial exclusion

In reference to the AnyTask™ Platform and the ETN-Network, CEO and Founder Richard Ells has stated that both of these startups aim to help reduce financial exclusion.

Mr. Ells said helping address financial exclusion has been possible by enabling the unbanked and underbanked access to the global digital economy via crypto apps, such as the ETN App that allows users to send, receive and transfer ETN worldwide at a fraction of a US cent.

“The AnyTask™ Platform, specifically, allows people with even just a smartphone, tablet, or laptop to sell their skills globally,” said Mr. Ells. “These freelancers then earn ETN (Electroneum’ Ltd’s native cryptocurrency) they can use for everyday items, payment of services, and to top-up their phones without requiring a bank account.”

Richard Ells and his ETN-Network and AnyTask.com teams were recognised in March 2020 by City AM with an award for Sustainability and Social Impact. Mr. Ells is scheduled to debate blockchain for social impact on 9 June at 14:50 BST (GMT+1) during the Blockchain for Europe Summit 2021.

Blockchain for social impact

Blockchain has already had a significant social impact. It has revolutionised FinTech as well and the reason why is very straightforward: it eliminates the middle person, the intermediary, thereby reducing costs and increasing transactional speeds. With the ETN App, for example, you can send value around the world in minutes at a cost equivalent to a fraction of a US cent.

READ: ETN-Network CEO to debate blockchain for social impact on 9 June

ETN is the ETN-Network’s native token. With the ETN App, let´s say you are from Nigeria but have emigrated to the United States in response to a job opportunity or in search of a different life for you and your family, who by the way stays behind while you kick things off. You are in New York and so you need to send back value.

From within the ETN App, users can top-up their friends’ and family’s Nigerian mobile phones from NY. You can purchase food and electricity and construction materials and instead of wasting time on the bus to go to a money transfer office and pay a fee for sending money abroad, you can do all that for pennies and from the comfort of home via the ETN App.

Deloitte, the UN, World Bank, and others agree

In a December 2020 article, the World Bank said “access to affordable financial services is critical for poverty reduction and economic growth. For poor people, especially women, access to and use of basic financial services can raise incomes, increase resilience, and improve their lives.”

Fintech and blockchain innovations are helping reduce the cost of providing services, making it possible to reach more people, and reducing the need for face-to-face interactions, essential for keeping up economic activity during the pandemic.

“Fintech has shown its potential to close gaps in the delivery of financial services to households and firms in emerging markets and developing economies,” said Caroline Freund, World Bank Global Director for Finance, Competitiveness, and Innovation.

The United Nations Capital Development Fund recently quoted a McKinsey Global Institute report that says digital finance alone could benefit billions of people by spurring inclusive growth that adds $3.7 trillion to the gross domestic product (GDP) of emerging economies within a decade.

An eight-page report by Deloitte concludes that blockchain technology can play a pivotal role when it comes to boosting financial inclusion. An 82-page Stanford University Report highlights that with over 2 billion unbanked, underbanked, or financially underserved people worldwide, opportunities for financial inclusion are tremendous.

“Some of the most pressing issues involved in offering access to the unbanked are solvable with the use of blockchain, including lowering transaction settlement time and costs, removing formal infrastructure requirements, and providing digital identity and property rights,” the report adds.

Crypto for financial inclusion

Blockchain Council is an authoritative group of 1,500 subject experts and enthusiasts from 300 companies in 90 countries who are evangelizing blockchain research and development, use cases, and products.

The council says that the introduction of digital currencies, empowered by blockchain technology, can be seen as a potential for empowering financial inclusion globally. It even allows developing nations to overlook traditional banking services and transact using just a mobile phone. Gaining access to financial services through digital currencies will allow people to improve their standards and raise their household incomes.

“Undoubtedly, cryptocurrency can drive financial inclusion as there is an urgent urge for monetary innovations, especially in the developing countries that will help in decreasing the cost of processing transactions, making the world less dependent on cash, and obviously increasing the mobility of money across the globe,” the Blockchain Council reiterated.

Beyond quickly transforming how people today create, store and transfer value, cryptocurrencies are accelerating financial inclusion in ways in which mainstream financial institutions have either been unwilling or unable. However, cryptocurrency’s possibilities go way beyond serving the unbanked. It enables developing nations and people without access to financial services to avoid the bank completely and transact and grow small businesses using just a mobile phone.

“Gaining access to financial services will allow financially excluded people to improve their lives, increase their earnings, raise their household income, and even stash away some savings for troubled times such as the ones we’re living in currently,” says a Cointelegraph article. “Entrepreneurs can gain access to credit to start a business and families can acquire land and livestock and ensure that the roofs over their heads are safe. Quality of life can be improved for all.”

Is there hope for the unbanked?

Yes, there is hope for the world’s unbanked and underserved. From the roughly 2 billion unbanked, underbanked, and financially underserved individuals globally, roughly two-thirds have mobile phones. With mobile phone and internet adoption growing quickly, financial services can be provided to the unbanked through their mobile devices, as does the ETN-Network with its unique ETN App. That means that anyone with a mobile phone can pay their bills or set aside a small amount every month in savings.

The WEF article previously quoted above concludes that cryptocurrencies and blockchain technology, paired with the global growth of mobile and indeed internet adoption, are tempering rising financial inequalities. Richard Ells had this clear in his mind when planning the launch of the ETN-Network’s smartphone-based ETN App.

And it is not inconceivable to imagine that in the coming decades, the world will have a much more democratised and accessible financial system. A major contribution towards financial inclusion could be achieved thanks to cryptocurrencies.

Read original article here.