By Clara Nchekwube Aghasili -Lingo and Emmanuel Yinka Fagbenle

Umbrella body for Nigeria’s network operators, the Association of Telecommunication Companies of Nigeria (ATCON) has condemned the plan by the Senate to impose 9% tax on telecoms and broadcast services warning that the moves could slow down the country’s ICT adoption.

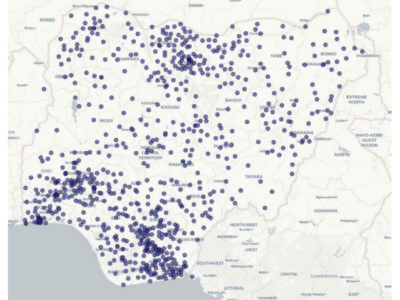

Despite having over 170 million telephone subscribers, Nigeria’s ICT penetration is still among the lowest in the world and cost of services among the costliest.

The impact of the adoption of 9% CST bill is that it is a double tax on voice, sms and data service as 5% VAT already applies on these services. This represents an additional burden when applied to a subscriber base of 173million. If the passage of this bill goes through it would negatively impact Nigerians and foreigners that use these services.

ATCON has cautioned that “the reemergence of 9% Communications Service Tax (CST) that was previously suspended by the 8th National Assembly during the intervention of ATCON NEC to the Senate President on Thursday, November 3, 2016” could mean further loss of jobs in an already struggling economy.

“The impact of the adoption of 9% CST bill is that it is a double tax on voice, sms and data service as 5% VAT already applies on these services. This represents an additional burden when applied to a subscriber base of 173million.

“If the passage of this bill goes through it would negatively impact Nigerians and foreigners that use these services. The implementation of this CST bill would take the affordability of data services out of the reach of the citizenry.

The implementation of this CST bill would take the affordability of data services out of the reach of the citizenry…. The passing of the bill would add to the burden of the already suffering Nigerians. It is deemed as an additional multiple tax, loss of revenue to the industry and can lead to loss of jobs in the sector.

“Therefore, ATCON recommends that government reconsiders the passing of the bill, as it would add to the burden of the already suffering Nigerians. It is deemed as an additional multiple tax, loss of revenue to the industry and can lead to loss of jobs in the sector,” said ATCON in a statement released in Lagos and signed by its president, Mr. Olusola Teniola.

ATCON has reiterated its recommendation to government that “the tax base of the country should be widened to include more tax payers. It was noted that only 13 million out 70 million were contributing to the tax revenue of the federal government.

Since 2016, Nigeria has under gone a recession and experienced low GDP growth rate coupled with government recurrent expenditure that now exceeds oil revenue. Therefore we understand that measures to shore up government income in the way of taxes should be explored,” said ATCON

“However, government needs to also consider a reduction in the cost of governance that will fit within the new government revenue generated through taxes and oil receipts. It is inconceivable that a CST Bill of 9% that was put aside which is a direct copy of Ghana’s CST is now being pushed through the National Assembly without due consultation with all stakeholders and it is especially targeted at the telecoms and ICT sector,” the worried association added.