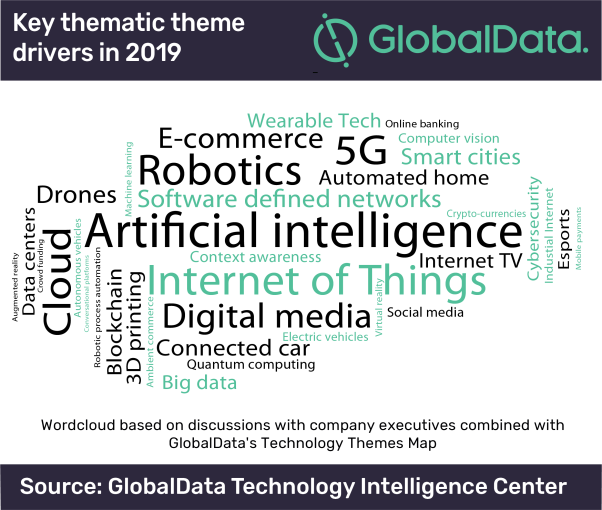

Artificial intelligence (AI), the Internet of Things and data centers were the key drivers behind mergers and acquisition (M&A) activity over the last two years, according to GlobalData, a leading data and analytics company.

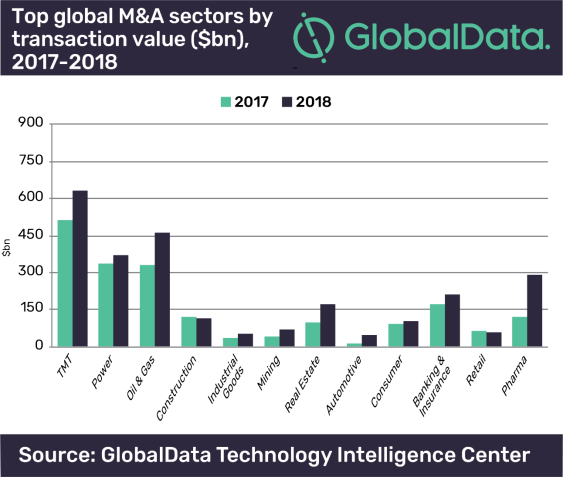

In 2018, the total transaction value of M&A deals announced in the global TMT sector reached $630bn, up 23% from 2017 and significantly ahead of other markets in both 2017 and 2018, according to GlobalData’s Deals Database.

GlobalData’s

latest thematic report, Mergers & Acquisitions in Technology Media and Telecoms (TMT), reveals the most

notable deals over the last five years, identifies their key thematic drivers,

and predicts potential future acquisition targets.

Cyrus Mewawalla, Head of Thematic Research said, “Running any business today

requires an understanding of all disruptive threats – and most of these threats

come from the technology sector. Whatever industry you are in, technology now

makes it easier for you to be disrupted. Those lining up to disrupt you are

smaller and nimbler, and they don’t compete on a level playing field with you.”

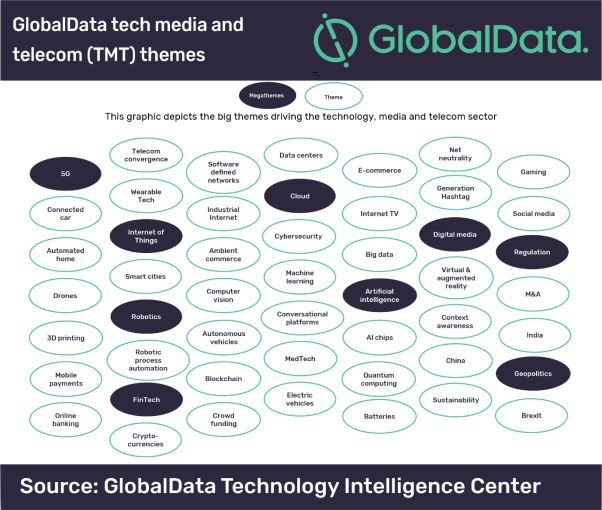

GlobalData’s technology thematic research shows that other disruptive themes include autonomous vehicles, medtech, adtech, internet TV, virtual reality (VR), augmented reality (AR), robotics, cloud computing and geopolitics.

AI, the Internet of

Things, robotics, cloud computing and 5G could be described as ‘megathemes’

regarded as likely to have the biggest disruptive impact on organizations.

Mewawalla adds, “We are witnessing increasing technology adoption across

industries as companies attempt to ride the wave of innovation and digital

transformation that is transforming industries from agriculture, to healthcare,

motor cars, defense, banking, insurance, construction, and energy.

“At the same time, as Generation Z takes center stage, demand for personalization, omni-channel experiences, and predictive customer care is forcing businesses to redefine every aspect of business to target changing consumption patterns and customer expectations. These key themes are forcing businesses across industries to review their strategies and business models – and then use M&A to tackle those disruptive themes, not merely to gain competitive advantage, but just to survive.”