By Eric Osiakwan

My July op-ed focused on the increased M&A activities in Africa under Covid-19. Network International announced the acquisition of Africa’s leading online commerce platform, DPO for $288M on 28th July 2020, confirming my analysis that we are going to see more M&A activities going forward.[1]“According to Keet van Zyl, Managing Partner of Knife Capital (which turned a decade last week), who managed Mark Shuttleworth’s ‘Here Be Dragons’ Fund – this is likely the largest tech acquisition in Africa since Shuttleworth sold Thawte to Verisign for $575m in 1999”.[2]SoftBank, which had a $16.5B loss in Q1, returned to a $12B net profit in Q2, courtesy of the merger and partial sale of its stake in Sprint to T-Mobile, as well as a recovery in its $100B vision fund portfolio.[3] This means global M&A is also picking steam in the “valley of coronavirus” as Masayoshi Son put it.

Under COVID-19, healthcare investments in Africa have also surged due to the demand and prominence of the sector as a result of the pandemic. These healthcare investments are ascending also due to the numerous innovations around access, data, testing, therapeutics and vaccine – in and around the continent.

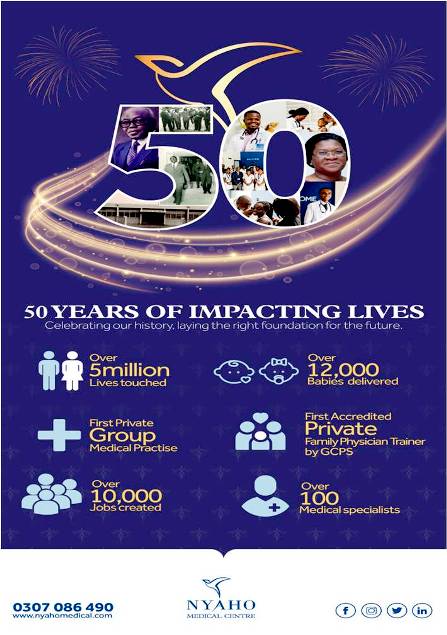

I will focus this op–ed on healthcare delivery and investment with three examples from Ghana, including Nyaho Medical Center on whose board I serve. The International Finance Corporation (IFC), the private sector arm of the WorldBank extended a $5.2M loan facility to the Nyaho Medical Centerto augment their operations in Accra and to expand into other parts of Ghana.[4]New Crystal Health Services (NCHS) also got a $2.5M loan from the IFC and an equity of 3MEuros from impact investment group, Investisseurs & Partenaires (I&P).[5]Helium Health a Nigeria healthtech venture raised $10M in May to expand their services across Africa.[6] That same month, Ghanaian healthtech company, mPharma raised $17M from the Commonwealth Development Corporation (CDC) and others.[7] In April, another Nigerian healthtech venture, 54Gene raised $15M in their series A lead by Adjuvant Capital (which was seeded by the Bill and Melinda Gates Foundation), Novartis, IFC, Ingressive Capital and others.[8]Before the virus hit, Consonance Investment Managers backed Lifestores, a tech enabled platform for pharmacies to provide access to healthcare for the last mile with a $1M investment in fresh capital to expand their operations in Nigeria.[9]

The Ghana Infectious Disease Center (GIDC), a 100-beds infectious disease and treatment centre, was opened on 24th July 2020 after the Ghana Covid–19 Private Sector Fund invested to get it from scratch to finish within 3 months duringthe pandemic.The Ghana Covid–19 Private Sector Fund, a consortium of the private sector in Ghana has so far raised GHC42M out of their targeted GHC100M and have done three things with the funds;

- Built the Ghana Infectious Disease Center within a record time of 3 months,

- Donated PPEs to the Ghana Health Service and

- Fed 150,000 people over a ten-day period.

mPharma, a data and cost management platform connecting Africans to affordable quality prescription drugs led by Gregory Rockson played a critical role in sourcing and distributing PPEs during the outbreak in Ghana. Between their series B of $12M and C of $17M[10] that happened during the pandemic – they acquired Haltons, Kenya’s second biggest pharmacy chain for less than $5M thrusting them into a critical position in the Kenyan healthcare space.[11]Since its launch, mPharma’s focus has been to make pharmaceuticals accessible and affordable so they became the go–to company during the pandemic, since they also help pharmaceutical companies to keep stock of their inventories.Over the years, the company has grown steadily (and through acquisitions)withoperations in five countries supporting over 250 pharmacies with total funding of about $40M to date. One of the investors in mPharma is Golden Palm Investments Corporation (GPIC) based in Ghana who also owns Africa Health Holdings – an investor in Carepoint and Rabbito Clinics Limited. Rabbito Clinics opened two additional branches in Accra during COVID19 bringing their total number of hospitals in Ghana to 15.

The GIDC cements Ghana’s impeccable record of growing the healthcare delivery space for the last 50 years sinceNyaho Medical Center was started in March 1970 by the late Dr. KwamiNyahoTamaklo. His vision was to give the best in nursing and medical care in Ghana and outside of its borders, as the first private medical establishment in the then independent Ghana. Nyaho was modelled after the world renown Mayo Clinic in the USA.In 2001 his wife Mrs. Janet Tamaklo took over the baton, moving the vision to second gear until her retirement in 2015.Vako Ferguson and Janis McKenna daughters of the founder were a critical part of the second gear in executive and non-executive roles at Nyaho.Meanwhile,their son, ElikemTamaklo had been training in medical practice in the UK and as faith would have it returned to Ghana to build on the vision and execution of his family from 2015 till now.

Elikem’s gear three has technology at the core of healthcare provision the Nyaho way. The Nyaho way is the corporate culture that has been handed down by the previous leadership and at the core of it is patient centered holistic care. Elikem’s vision of the future is using technology to drive patient-centered careholistically across Africa. That started with investment in the technology infrastructure both on the airport campus which is the hub of operations and the Octagon satellite facility in old downtown Accra – the first spoke. Additional spokes are planned for Tema, Kumasi and Takoradi using high–speed links to interconnect them so they can share information and transact in real-time with patients.

Nyaho already has a state-of-the-art Health Information System (HIS), so doctors use their computers to input and extract information when consulting with patients. This means every patient’s health information is electronic and stored in very secure servers that are backed up remotely. Nyaho has partnered with Clearspace Labs to build Serenity Health – an electronic medical records (EMR) system that currently enables, online COVID–19 assessment anywhere and then connects you to a medical facility, if necessary, it also enables virtual healthcare. This is the beginning of the next 50 years of the Nyaho way – holistic patient–centered healthcare delivery across Africa.

“This oped is in honor of my friend and investor colleague Christopher Yebuah of Casey Family Program who passed away in the line of duty and is being put to rest today – fare de well Bona —- from the Chanzo Capital team.”

[1]https://gulfnews.com/business/banking/network-international-to-acquire-africas-leading-online-commerce-platform-dpo-for-288m-1.1595955372576?fbclid=IwAR3oX5a1BYsHIRGivJD-fDl_LznIwCHxuSVcEGMtyPE2z3SJL0XthoCrYzw

[2]https://digestafrica.com/exits

[3]https://www.forbes.com/sites/vidhichoudhary/2020/08/11/softbanks-record-12-billion-profit-shows-dramatic-turnaround/#79147ba52504

[4]https://ifcextapps.ifc.org/IFCExt/Pressroom/IFCPressRoom.nsf/0/5F2CD36CCB89F3AB8525859F00588D50

[5]https://www.ghanaweb.com/GhanaHomePage/NewsArchive/Private-hospitals-need-strategic-partnerships-Prof-Akosa-1023358?channel=D2

[6]https://techcrunch.com/2020/05/06/nigerias-helium-health-raises-10m-series-a-for-africa-expansion/

[7]https://ventureburn.com/2020/05/ghanaian-startup-mpharma-raises-17m-investment/

[8]https://qz.com/africa/1837527/54gene-raises-15m-from-bill-melinda-gates-backed-fund/

[9]https://www.askifa.ng/life-stores-raised-n365-million-for-the-expansion-of-drug-distribution-in-nigeria/

[10]https://technext.ng/2020/05/26/mpharma-raises-17-million-and-appoints-ex-ceo-of-us-pharmaceutical-chain-cvs-pharmacy-to-its-board/

[11]https://technext.ng/2019/03/28/as-mpharma-acquires-kenyas-second-biggest-pharmacy-chain-haltons-is-startup-acquisition-becoming-a-new-trend-in-africa/