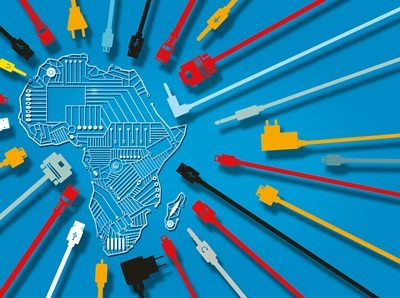

The latest report in CR2’s Market Insight series believes traditional banks can still gain an edge in Africa’s massive market for the unbanked online despite the rapid fintech transformation led by younger, more dynamic finance companies.

Africa is in the midst of a fintech transformation. Millions of Africans are now connected to financial services as a result of hundreds of start-ups. However, with the right mix of innovation and partnerships, Africa’s established commercial banks can gain an edge in the continent’s digital finance revolution.

RELATED How FinTech Is Changing The Rules Of The Game In Africa’s Banking Sector, By Sunil Kaushal

This latest report in CR2’s Market Insight series discusses how Africa represents a massive market that is providing opportunity for investors to bring large segments of the continent’s unbanked online. The surge of start-ups has been a major factor throughout this transformation, but they are not the only players on the continent. Established banks are also building on legacy infrastructure and client networks to offer novel digital finance services.

Read this report to learn how many longstanding financial institutions in Africa are pursuing innovation—such as online wallets and digital payments services—to bank the unbanked and meet the preferences of an on-demand generation. Africa’s banks shouldn’t make this journey alone, however, partnering with fintech start-ups and technology partners can accelerate their route to success.

To read CR2’s full report on Africa’s Fintech Transformation and how traditional banks can still gain an edge, Africa’s Fintech Transformation (https://bit.ly/3081a5P).