Africa’s e-commerce boom means opportunity for global merchants!

A recent report finds that Africa’s booming market for online goods and services is on track to surpass half a billion consumers by 2025, highlighting untapped potentials for global merchants and payment service providers. Emphasizing Africa’s mobile-centric consumer base, the report details how access to Local Payment Methods can boost business success in Africa’s diverse markets.

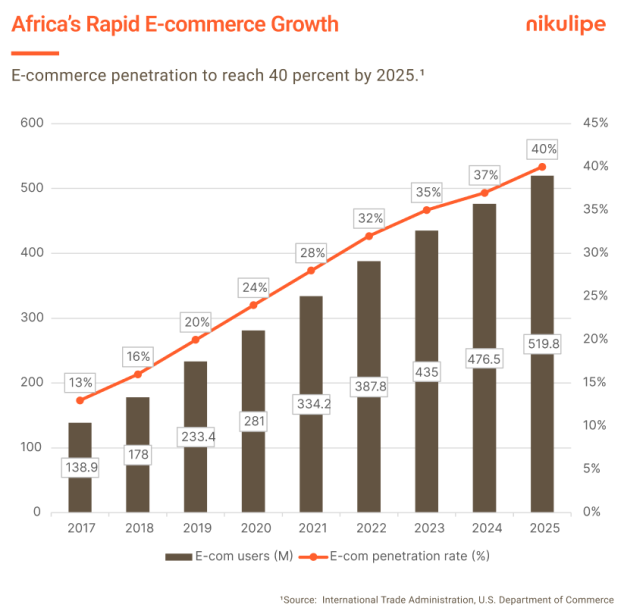

By the end of 2025, nearly half the population of Africa will have engaged in buying goods and services online, compared to just 13% in 2017. This increase will be fueled by Africa’s young and growing tech-savvy population—70% of Sub-Saharans are younger than 30—and a surge in mobile connectivity across the continent.

RELATED: Why E-commerce is Thriving in South Africa

This e-commerce growth offers unprecedented opportunity for global businesses, according to findings detailed in a recent report titled “Payments and E-Commerce in Africa,” released by Nikulipe, a global Fintech company that focuses on Local Payment Methods in Fast-growing and Emerging markets.

The expected growth of Africa’s active internet users, from 570 million at the end of 2022 to almost 900 million by 2028, will largely be driven by increased smartphone adoption, which is projected to approach the 92% global average in most Sub-Saharan countries by 2030.

Nikulipe’s report positions this sweeping digital transformation as a major opportunity for payment service providers and global merchants to expand into Africa’s Fast-growing and Emerging markets. However, the report also reveals that any company looking to enter the continent’s emerging markets will need to carefully account for local payment method preferences.

Africa’s focus on mobile money

A key finding of Nikulipe’s report is the transformative role mobile money plays in Africa’s economy. With the rise in mobile adoption across the continent, mobile money has become an indispensable financial tool, particularly for Africa’s unbanked populations.

Frank Breuss, Co-founder and CEO of Nikulipe

“Mobile Money was a key driver for Financial Inclusion in Sub-Saharan Africa, a region where less than 10% of the population have access to credit cards and only 33% have bank accounts,” explains Frank Breuss, Nikulipe’s Co-Founder and CEO. “Today more than 560 million people in Africa pay via their phone and the number is predicted to reach 850 million by 2028. This is a huge and mostly untapped opportunity for global merchants.”

By the end of 2022, Tanzania alone reported that 77% of its population over 15 years old were mobile money users, a testament to the deep integration of mobile financial services in daily commerce. “Understanding the mobile-centric habits of African consumers will be key to successfully entering this growing market,” Breuss notes.

Region-specific mobile payment dynamics

The report highlights the key fact that mobile payment method preferences differ from region to region and country to country in Africa. In Uganda, for example, MTN Mobile Money and Airtel Money are the dominant LPMs, while in neighboring Kenya, M-Pesa is the market leader.

“Africa, with its 1.4 billion potential new customers, offers huge opportunities for international merchants both for digital and physical goods. Understanding regional preferences and offering the right mix of payment options available to the local customers is vital for the success.” Breuss explains.

Facilitating access to emerging markets

Nikulipe supports global merchants to overcome the challenges of entering Africa’s Emerging Markets.

“Our one-contract and one-API offer allows Payment Service Providers and Global Merchants to easily connect with multiple African markets by offering access to Africa’s most relevant Local Payment Methods,” Breuss explains.

Adding: “We combine the security of a European Financial license with the expertise of being locally present in Africa. We also cover the full transaction value chain, from payment processing to local fund collection, currency conversion, and remittance of funds back to our client’s bank accounts outside Africa.”

This approach helps reduce the complexity and time required to enter new markets, allowing international merchants to focus on scaling operations and growing their customer base in one of the fastest-growing regions of the world.

Nikulipe’s assessment of Africa’s e-commerce sector offers crucial insights that can help businesses optimize their strategies and harness the full potential of a growing market.